US Stocks Trump the World

But will Trump 2.0 mean the end...?

PRESIDENT TRUMP will re-enter office at a very interesting time for US

stock markets, says Adam

Sharp in Addison Wiggin's Daily

Reckoning.

America is absolutely torching the rest of the

world.

Today

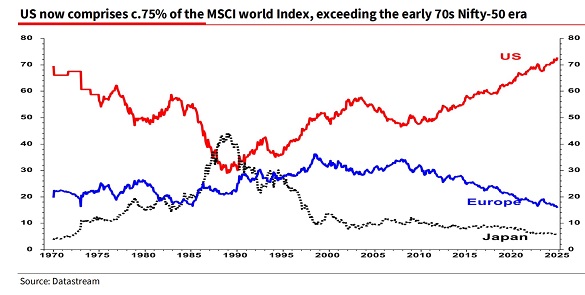

American companies make up a whopping 75% of the MSCI World Index. It contains shares of the largest

stocks from Europe, Canada,

Singapore, Australia, Japan, New Zealand, Israel, and the United States.

The MSCI World Index is a very

important index, as it forms the

basis of large ETFs and other investment vehicles. Today it's utterly dominated by American

companies.

Over

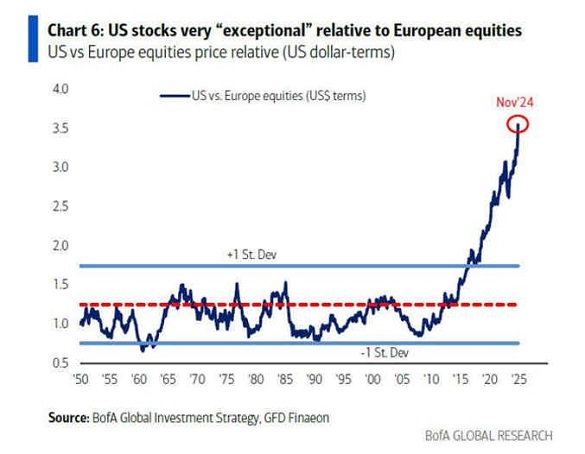

recent history, American stocks have dramatically outperformed the rest of the world, especially

Europe.

US

stocks have returned almost 4x more than European ones over the last 14 years!

It's been a historic winning

spree of performance. Now the question is...

Can it last?

Take a look

at our

charts again.

Notice that, at the top, Japan made up over 50% of the MSCI World

Index in the late 1980s. It

was bigger than the US!

A tiny country with around 126 million people had a

majority of the World Index. And

now it's less than 7%.

We can see that during the period of Japanese

exceptionalism (it peaked in 1989), the

US dropped from about 70% to 30% of the MSCI World Index. Times do change, eventually.

I believe we're

nearing another peak of US market exceptionalism. I'm not saying it's going to be immediate, but make no

mistake, stocks can't go up

like this forever.

US stocks have reached ridiculous valuation levels. Take a

look at a simple stock like

Walmart (WMT). The retail giant is currently trading at 38x earnings (a 38 P/E), while growing revenue

at 5%. That's rich. A great

company, no doubt. But a very expensive valuation, especially considering the upcoming changes to

American tariffs.

We're in serious bubble territory across the board. The S&P 500 has an average

price/book of over 5.2x. The top 10

stocks in the US trade at about 49x earnings on average.

In about 45 days,

President Trump will take office.

Markets are (validly) excited about this prospect. But we should tamper our expectations given the

pre-existing bubbly

conditions.

Voters have charged him with bringing about the most ambitious

reforms the country has seen in

decades if not a century.

Trade policy will be overhauled. Immigration policy

will change

dramatically.

Immigration and trade alone have the potential to reshape the

American workforce and

economy.

Add in better energy policy (drill baby, drill), lower taxes, and RFK

Jr.'s Make America Healthy

Again (MAHA) movement, and we have a recipe for fireworks.

Trump will also

enter office at a time in which US

tech companies are beginning to face serious foreign (mostly Chinese) competition. Take a look at Apple

iPhone sales in China, which

are finally facing major challengers such as Huawei And Xiaomi. In social media, companies such as

TikTok parent Bytedance are cutting

in on a previously US-dominated market. And in electric vehicles, Tesla is losing out to rising giants

like BYD.

Oh yeah, and as I've already mentioned, we are also in the middle of a massive stock

bubble.

It's going to be an incredibly disruptive next few years. Good, great, bad, and ugly. We're going to see

it all.

Investors face a daunting task preparing for such conditions. This period promises to be

wild and unlike anything we've

seen for decades.

Market crashes, real reform, political clashes, buying

opportunities, the deep state

strikes back. All of that.

Email

us

Email

us