Silver Deficit, Gold $2700, and the Coming Oil Glut

Reviewing H1 2024's commodity winners...

IF YOU were in charge of the Fourth of July spread this holiday, you

probably noticed a hike in prices,

says Frank Holmes at US

Global Investors.

According to the American Farm Bureau

Federation, the cost of a typical

Independence Day spread for 10 people jumped to $71.22 this year, up 5% from last year and a whopping

30% from five years

ago.

That may not seem like much, but this inflation has a compounding effect

on commodities.

Research from Goldman Sachs shows that a 1 per centage point increase in US inflation has

historically led to a real

return gain of 7 per centage points for commodities. Meanwhile, the same trigger caused stocks and bonds

to decline by 3 and 4 per

centage points, respectively.

This data supports the potential of commodities

as an inflation hedge. In times

of rising prices, having exposure to tangible assets like silver, oil and gold often retain their value

better than paper

assets.

The reason I mention silver, oil and gold is because they were the top

performing commodities in the

first half of 2024. Let's dive into what's driving these trends and what they might mean for

investors.

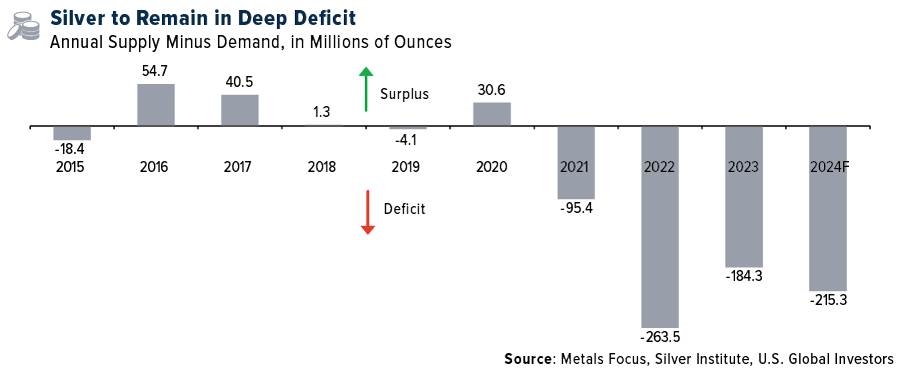

Leading the charge is silver, up close to 22.5% in the first half. The "poor man's gold" is proving its

worth, driven by a global

supply deficit and increasing demand.

Back in

January, the Silver Institute

forecasted that global silver demand will reach a near-record 1.2 billion ounces in 2024, up 1% from

last year. This growth is

primarily fueled by industrial applications, particularly in the booming solar energy

sector.

We're looking

at the fourth consecutive year of a structural market deficit in silver. The deficit is expected to

widen by 17%, reaching 215.3

million ounces. Loyal readers should be aware of what happens when demand outstrips supply – prices tend

to rise.

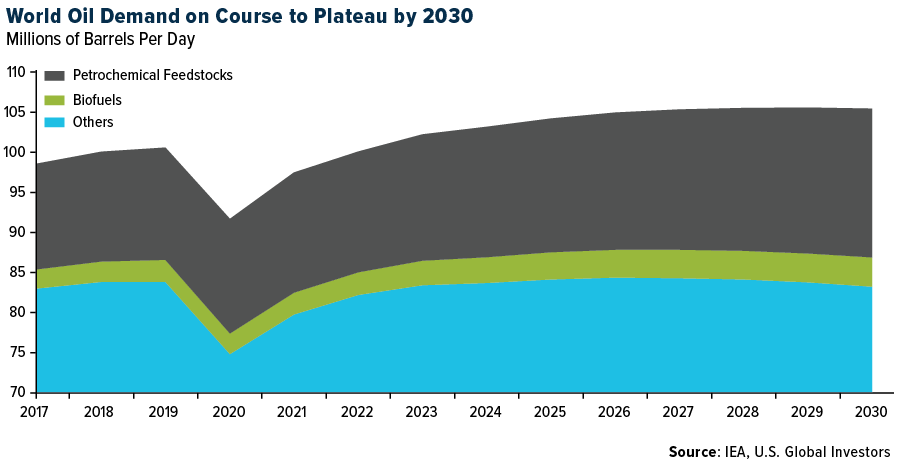

Oil, our second top performer with a gain of 13.8%, continues to demonstrate its staying

power in the global economy.

Despite the push for electrification, oil demand remains robust.

According to a

new report by the

International Energy Agency (IEA), we're approaching a significant turning point. Global oil demand,

which averaged just over 102

million barrels per day in 2023, is expected to level off near 106 million barrels per day toward the

end of this decade. This plateau

in demand coincides with a projected surge in global oil production, particularly from non-OPEC+

producers.

The implications

of this forecast are profound. We're looking at a future where oil supplies could reach levels of

abundance unseen outside of the

pandemic. This potential oversupply situation could exert downward pressure on oil prices.

It's worth noting

that the IEA's outlook contrasts with some other forecasts. Goldman Sachs Research, for instance,

expects oil demand to continue

growing until 2034, potentially reaching 110 million barrels a day. They cite increasing demand from

emerging Asian markets and the

petrochemical industry as key drivers.

Last but certainly not least is gold.

The yellow metal has shone

brightly in 2024, rising 12.8% year-to-date and outperforming many major asset classes. This performance

is particularly impressive

given the high interest rates and strong US Dollar – conditions that ordinarily create a challenging

environment for gold.

What's behind the metal's resilience? It's a perfect storm of factors: continued central

bank buying, strong Asian

investment flows, steady consumer demand and persistent geopolitical uncertainties. In its midyear

outlook, the World Gold Council

(WGC) estimates that central bank demand alone contributed at least 10% to gold's performance in 2023

and potentially around 5% so far

this year.

Looking ahead, Goldman has set a bullish target of $2700 per troy

ounce for gold by year-end.

That's an increase of about 16% from current levels. They cite solid demand from emerging market central

banks and Asian households as

key drivers.

Many investors, myself included, appreciate gold's potential as a

hedge against both inflation

and geopolitical risks. It could provide a buffer against potential stock market volatility, especially

if trade tensions escalate.

Additionally, gold might see further upside if concerns about the US debt load increase or if there's a

shift in Federal Reserve

policy under a new administration.

As we move into the second half of 2024, the

commodities market continues

to offer intriguing opportunities. Silver's industrial demand, particularly in the green energy sector,

presents a compelling growth

story. Oil remains a critical resource, especially for emerging economies, despite the global push

towards renewables. And gold, the

eternal safe haven, continues to prove its worth in uncertain times.

Email

us

Email

us