Election 2024: All Roads Lead to Inflation

So buy gold and silver, right...?

WITH ONLY one week remaining before the US presidential election, there's

a growing sense of

uncertainty in the air, writes Frank Holmes at US Global

Investors.

Investors are wondering how to position their money,

bracing for the possibility of

significant volatility and market shifts.

While some hedge funds are making

bold moves on so-called "Trump

trades", we at US Global Investors see things differently.

In fact, I share

billionaire hedge fund manager

Paul Tudor Jones' recent outlook on gold and Bitcoin (which validates what I have been writing about for

many years). Like him, we

currently favor alternative assets as the smart play going forward.

It's not

that we're betting against

stocks or the economy, which we believe will do well over time no matter who wins the White House next

month. Nevertheless, the

writing is clearly on the wall:

Ballooning US debt and geopolitical tensions

all point to the need for a

strong hedge.

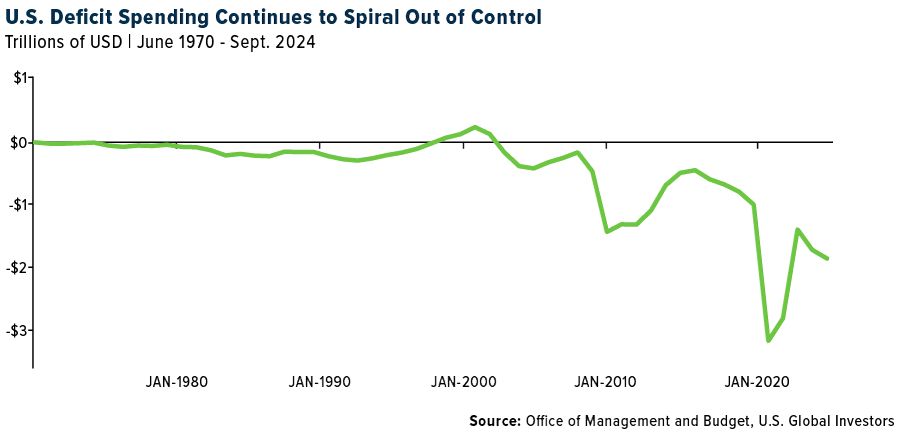

You won't be surprised to read that the US debt situation has

spiraled out of control. Just 25

years ago, the national debt was a little under 60% of GDP. Today, that rate has doubled to

120%.

According

to Paul Tudor Jones, founder and CEO of Tudor Investment Corp., this puts the US in a precarious

position – ne that's unsustainable in

the long run unless serious action is taken to rein in government spending.

We

all know that politicians have

a knack for promising more spending (in the Democrats' case) or tax cuts (in the Republicans' case) to

keep voters happy. It's easy to

see why Jones is concerned that either approach will only exacerbate the debt problem. As he pointed

out, the US is "going to be broke

really quick unless we get serious about dealing with our spending issues."

That's not just a dramatic

soundbite – it's a reality check. The federal deficit for 2024 soared above $1.8 trillion, up 8% from

the previous year. Meanwhile,

the debt burden, which is rapidly nearing $36 trillion, shows no signs of easing.

US federal deficit of

tax revenue to government

spending

When the government keeps printing money to finance its spending, the

inevitable result is

inflation. And in times of inflation, the purchasing power of traditional assets like bonds

erodes.

That's

why Jones favors assets that perform well in inflationary environments such as gold, silver, commodities

and Bitcoin. I agree

wholeheartedly with this assessment.

Think about it: Why would you want to own

fixed-income assets when

interest rates are being adjusted and are likely to be lower than the inflation rate? Long-dated bonds

are particularly

vulnerable.

US banks, remember, are still dealing with billions of Dollars in

unrealized losses on their

fixed-income positions. According to Florida Atlantic University's bank screener, Bank of America's

unrealized losses on

held-to-maturity investments in the first quarter were a staggering $110 billion, more than any other US

institution by

far.

The Fed will likely try to "inflate" its way out of this mess, meaning it

will keep nominal interest

rates lower than inflation to support economic growth. For investors, this means that preserving wealth

will require smart positioning

in alternative assets.

Jones is already betting against the bond market – "I am

clearly not going to own any

fixed-income," he told CNBC last week – and I believe many investors would be wise to take a similar

approach.

Let's start with gold and silver. Both have been go-to haven assets for centuries, and for

good reason. When geopolitical

tensions have risen, when inflation has reared its ugly head and/or when there's been uncertainty in the

markets, investors have

flocked to gold and silver.

This year is no exception. We've seen gold shatter

records multiple times in

2024, with prices rising more than 32% year-to-date, the metal's best annual growth since

1979.

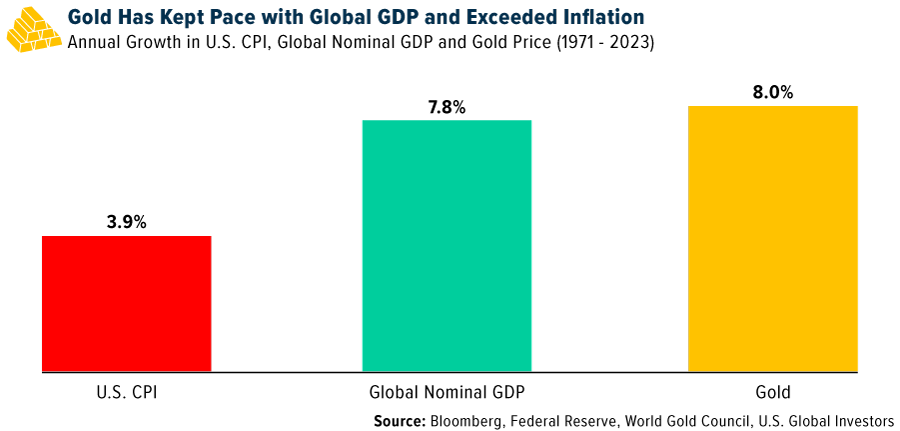

According to

data from the World Gold Council, gold has consistently outperformed both inflation and the growth rate

of the world economy. From

1971 to 2023, gold's compound annual growth rate (CAGR) was 8%, compared to 4% for the US consumer price

index (CPI) and 7.8% for

global GDP growth.

Silver,

often dubbed the "poor man's

gold," is another asset that deserves attention. With its industrial applications, especially in the

green energy sector, silver has

strong potential for future growth. According to one projection, the clean energy transition could

dramatically increase the demand

for silver in photovoltaic (PV) technology, potentially consuming between 85% and a jaw-dropping 98% of

current global silver reserves

by 2050.

Now, let's talk about Bitcoin. The world's largest digital asset has

quickly become a preferred

store of value for many investors, especially those looking to hedge against fiat currency depreciation.

Nearly half of all

traditional hedge funds currently maintain exposure to cryptos, including Bitcoin.

Institutions are also

backing Bitcoin with the same enthusiasm. Just look at BlackRock's Bitcoin ETF. It's one of the

fastest-growing ETFs in financial

history, with assets under management now over $26 billion. That's no small feat.

Bitcoin's decentralized

nature, capped supply and growing institutional acceptance make it an attractive asset in times of

uncertainty. Like gold, it's a

hedge against inflation, but it also offers the potential for significant upside as more investors and

institutions recognize its

value.

Now, I know you may be wondering: "What about the election? What if

Trump wins? What if Harris

wins?"

Here's a news flash for you: Over the long run, it may not matter as

much as you think. Larry Fink,

CEO of BlackRock, made a great point recently when he said that he's "tired of hearing this is the

biggest election in your lifetime.

The reality is over time, it doesn't matter."

While hedge funds are taking

positions in "Trump trades" like

private prisons and fossil fuels, we believe that trying to time the market based on election outcomes

is a risky game. Yes, the

election will cause short-term volatility, but if you're in the right assets – like gold, silver and

Bitcoin – I believe you'll be

well-positioned to weather the storm.

Email

us

Email

us