Time to Buy Gold Mining Stocks?

Patience remains gold-mining investment's key virtue...

GOLD MINING stocks are among the most hated equities in the stock market,

but that will change as the

macro shifts in their favor for the first time since 2001-2003, writes Gary Tanashian in his Notes

from the Rabbit Hole.

It is the nature of the masses, the majority, the consensus...the HERD...to follow the

trend.

It

is a lot easier to swim downstream than to fight the current. Just go with the flow. And from a

US-centric view the flow has, with a

blessed interruption from 2001 to 2003, been inflationary monetary policy free flowing into asset

markets as needed and on demand at

every point of financial crisis since. Armageddon '08 and the Covid crash were two primary

examples.

With the

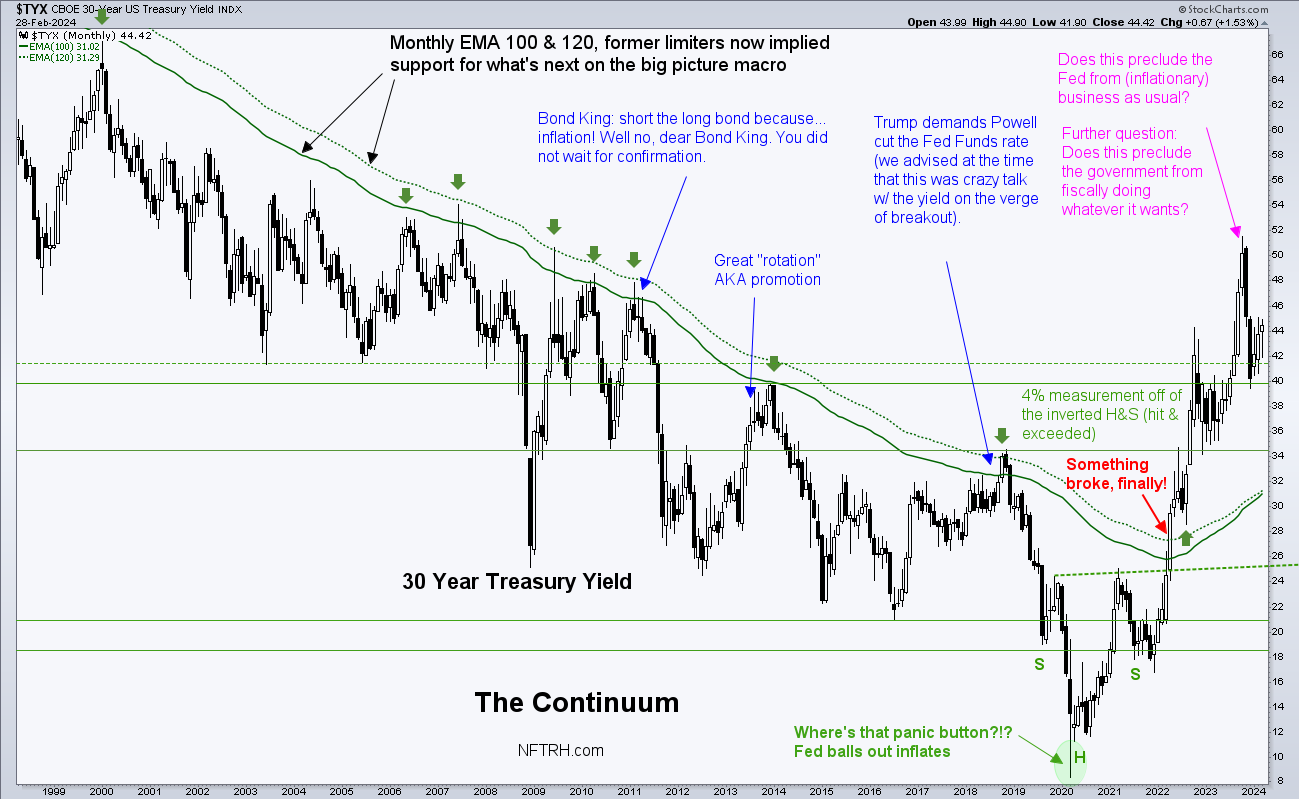

30-year Treasury bond yield 'Continuum' lower squarely showing a disinflationary trend for decades, full

license was given to our

policy heroes to act, mopping up each crisis with an unrelenting fire hose of 'Whatever it takes!'

monetary policy.

Throw in a side order of government (democrat or republican) always willing to spend and

stimulate its favored areas

(often very different areas per the party in power, but favored areas nonetheless) and you've got an

ongoing bubble in monetary and

fiscal policy. You also got a toxic environment for the wretched companies that dig the monetary metal

(which is well outside the

'debt for growth' system) out of the ground.

This chart tells a story of

something that was in place for

decades (going back to the 1980s, not shown on this chart) that is no longer in place.

30 year Treasury

yield

continuum, which implies a new macro and a new era for gold stocks

In my

opinion, markets operating as if all

is as it has been (hello US headline indexes, bad breadth and all) are dead men walking.

The Continuum is a

pictorial view of the funding mechanism of the bubble. Well, the mechanism is severely altered, if not

broken.

I began this post with the intention to keep it very simple and have already veered from

that course. So let's get it

back on course. Let's take a look at gold mining stocks through the prism of their relationship to gold

and gold's relationship to

other markets.

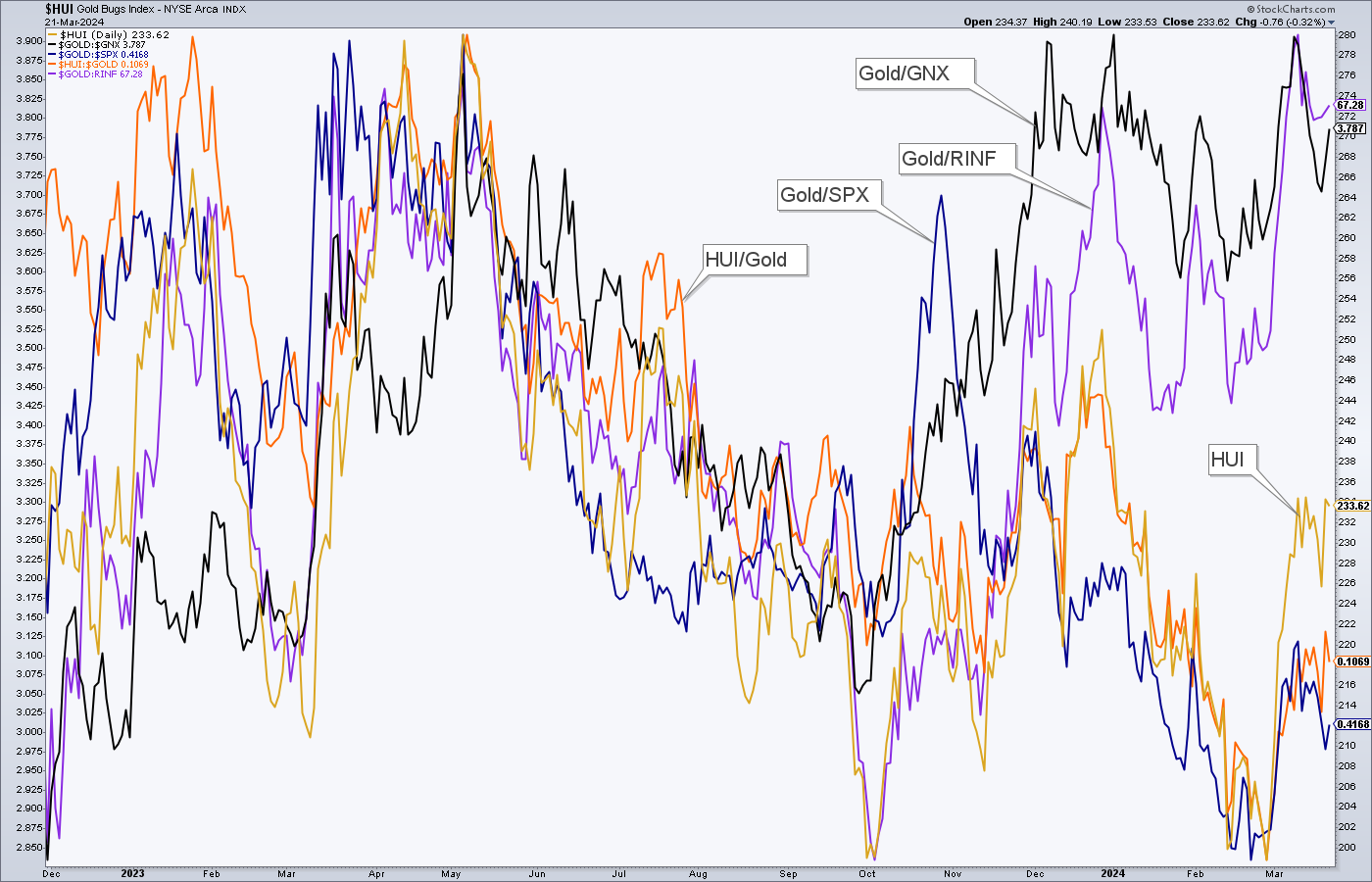

This daily chart shows that in 2023 gold stocks (HUI) had

rightly traveled both positively and

negatively in line with their best fundamental gauges. Those are gold's relationships with commodities

and inflation.

When

gold declined in relation to inflation signalers like 'inflation expectations' gauge RINF and commodity

index GNX, gold stocks

declined right along with them. As it became apparent that inflation was weakening and gold rose vs.

those items, gold stocks

rallied.

Then came the disconnect and positive divergence (for gold stocks) by

gold's relationship to the

inflation signalers (RINF, GNX, etc). I believe this happened because the herd finally bought the

disinflationary 'Goldilocks' (soft

landing or even NO landing) story as euphoria set in and Tech/Growth stocks gained momentum.

The hard decline

by HUI from Q4 2023 to Q1 2024 aped the decline in gold vs. the stock market (SPX). Of course, the

HUI/Gold ratio tagged right

along.

"Gold stocks suck!" demands the herd. And the herd is right; for

now.

The

NFTRH view has for over a year been for disinflationary Goldilocks to be followed by an uncomfortable

decline in inflation. In other

words, a deflation scare, quite possibly as a precursor to the next terrible inflation phase out in 2025

or thereafter.

With indexes like SPX, NDX and SOX still orbiting in blue sky the Gold/SPX ratio is in the

tank and right along with it

have been gold stocks (and their ratio to gold). While Gold/GNX and Gold/RINF have represented a

positive divergence for gold stocks,

Gold/SPX has been quite the opposite. Hence, we await the end of the currently at high risk bull market

in stocks.

Here is the same chart, expanded to a long-term view showing the 2001-2003 period when

Gold/SPX rose, Gold/GNX rose and

by extension, HUI/Gold and nominal HUI rose. There was no such thing as an 'inflation expectations' ETF

back then, but using TIP/TLT

or TIP/IEF, you'd get the same result; gold rising in relation to those ratios.

After 2003, gold mining

stocks entered a bubble as they blasted off to the stratosphere despite a negative macro as gold

under-performed commodities and flat

lined vs. stocks during that inflationary time.

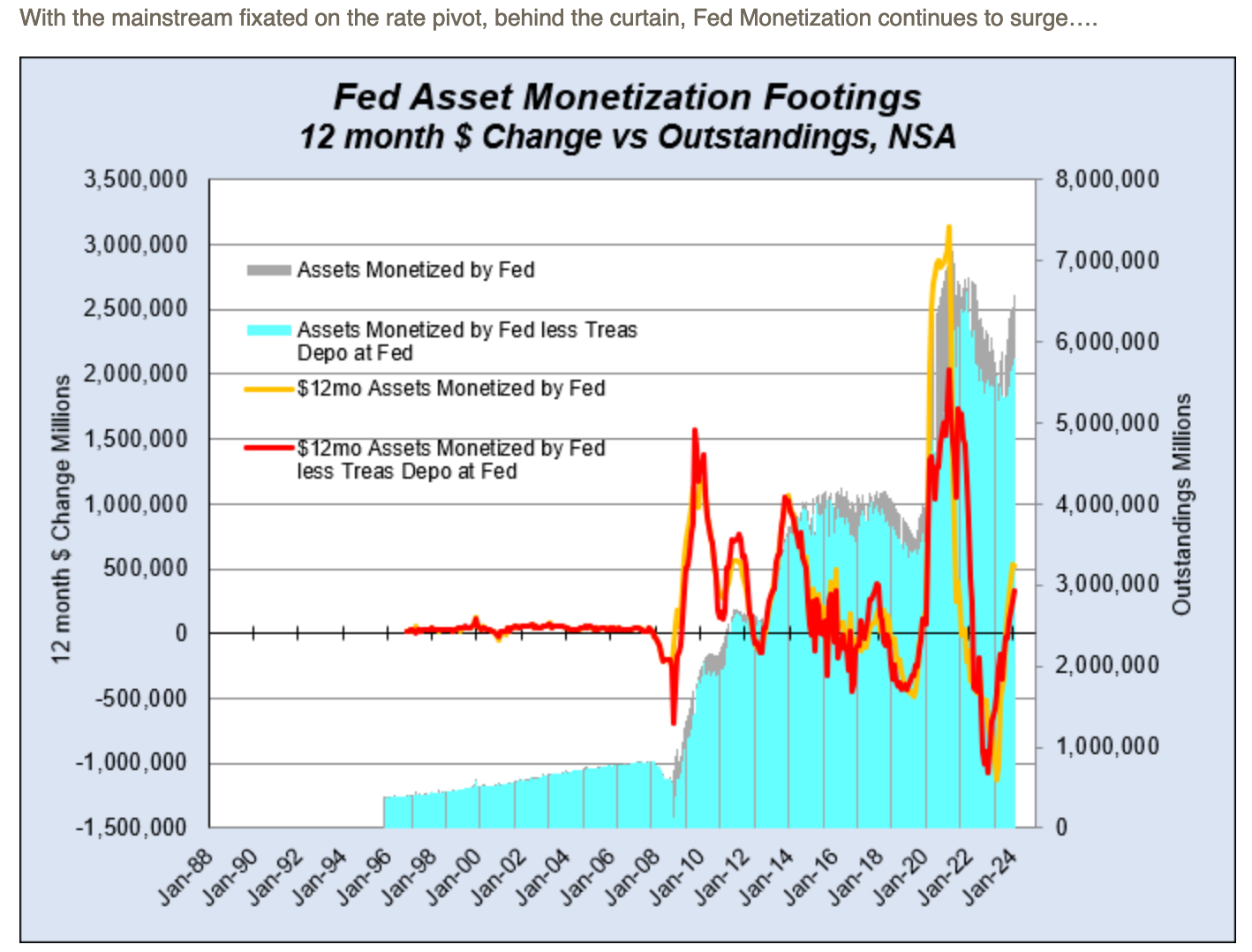

I usually disregard political rancor in my analysis,

but this year I have been hit over the head with the fact that the Fed has been monetizing out the back

door while playing tough guy

on TV (to the public).

It is not lost on me that Biden administration Treasury

Secretary Yellen is the Fed

chief who preceded Powell and is probably hard wired to him. My tin foil hat thesis is that she's got

his ear, if she's not actively

coordinating with him.

Here again is NFTRH subscriber Michael Pollaro's graph

showing the sneaky monetization

of debt ongoing, as if a regulator or pressure release to its hawkish Fed Funds policy as consumed by

the public.

As

a side note, to say I am proud of and even awed by the sophistication of the NFTRH subscriber base would

be an understatement. This

man has been doing this kind of work longer and much more astutely than I.

So

we have established that the

Fed has been hawkish, but not really. Now let's also consider that the massively contentious, rancorous

and frankly, scary election

year of 2024 is for all the marbles. Let's consider that the Biden administration has got the

Semiconductor CHIPS Act in its hip

pocket as well as whatever new 'Green' and/or 'infrastructure' initiatives it may activate to

temporarily stimulate the

economy.

In my view they will hold some cards close to the vest until a

strategic moment this election year

and then let 'er rip. The Trump candidacy could be incinerated in one fell swoop if the economy gets

goosed at the right

time.

The above represents both Monetary (Fed) and Fiscal (government) policy

potentials and is a reason I

have had to revise my original view for the stock rally from Q1-Q2, and then Q4, 2023 to potentially

into or even through the 2024

election. "Potentially", mind you. With the risk levels (by so many indicators beyond the scope of this

article, but illustrated

frequently over the last several months) currently in play, a condition (although not a timer) for a top

is already in

place.

Circling back to gold stocks, the miners' product is doing just fine, up

there in blue sky as well.

Although gold's blue sky is nothing like the bubble beneficiaries like the major stock indexes. But if,

like me, you think the stock

market is a dead man walking, it will only be a matter of time before the macro fully aligns for gold

stocks and the massive

pro-stocks herd, which would never consider a filthy investment like gold stocks, ends up wrong as it

always does sooner or

later.

It's been a long time since 2003. A couple decades is too long to fight

a market based on principle. I

believe strongly in giving my best effort to illustrate what I see, not what I want to see.

What I see now is

a big macro shift in progress. Not complete, but methodically progressing.

Patience.

Email

us

Email

us