Can the USS Lollipop Sink Anti-Bubble Gold?

Strong jobs report fails to burst bullion's bull run...

AFTER more standout jobs data, we note that the macro is indeed changing

beneath the surface,

writes Gary Tanashian in his Notes from the Rabbit Hole.

Another payrolls report, another beat

of expectations. The

breakdown illustrates a phenomenon I've been watching unfold for several months in a row; that of

unabated government hiring this

election year.

The USS Good Ship

Lollipop sails along, supported by

its vast services economy and construction (a product of the services industries, not a productive

industry itself, unlike for

example, manufacturing) as well as a continued trend of brisk government hiring this election

year.

I am not

going to play politics (I am dispirited by both major parties) but as usual, I am going to lay out facts

so that we can properly

manage the situation from an investment perspective.

The string of government hiring has been anecdotal, as

seen by my eyes and recollected by my brain over the last many months.

But

above is something a little more

concrete, courtesy of the St.Louis Fed.

Government employment has ticked a new

all-time high. Since June of

2022 the figure has been robo-trending upward.

So the Payrolls picture appears

rosy as all those services and

all that governmental bloat continue apace as the public debt ticks above $34 Trillion.

It is beyond the

scope

of this article to go into the details of why this leveraged disaster in waiting has not yet resolved

into negative market price

action. There are many other warning indicators in play. But my work implies that certain forces are

doing their best to keep up

appearances this election year.

I try to keep my tin foil hat in excellent

working order and only use it on

very rare occasions, when FACTS actually line up with tin foil.

"Facts" have

indicated a fiscally stimulative

government and logic has considered the potential of former Fed chief Yellen to be in coordination with

the current Fed, which has

been regulating liquidity through its bond markets operations.

Some question

why gold didn't get hammered on

the joyous employment news. Well, maybe it is just time.

With such an obvious

farce as the painting of the

jobs picture by government hiring and knock on effects (in construction and services) of governmental

debt spending to keep the

economy fiscally stimulated this election year, gold is simply looking ahead; jumping the creak if you

will. Currently it is acting as

an inflation scout (one of its utilities, under the right circumstances), but in my opinion it is also

looking beyond

that.

Gold is the anti-bubble after all, and it appears not to be waiting for bubble markets to

pop before getting a move on

into the new macro picture, which will be post-bubble and counter-cyclical with, in my opinion, some

severe market liquidity issues

out ahead, possibly later in 2024 or early 2025. NFTRH has two targets for gold based on patterns. One

is within hailing distance at

2450, and the other, 3000+, is in the offing. Likely after some bloody battles are fought along the

way.

As

for the dead men walking, the major US stock indexes are still bulling along. SPX, for example, a

primary beneficiary of bubble

policy, clings to its daily EMA 20 and by the SMA 50 (blue), its uptrend from October, 2023. All those

gaps below? They'll be

addressed one day. But for now, this dead man keeps on walking because...payrolls! Because...fiscally

stimulating government!

Because...Fed tight, but not too tight!

I believe there is a good chance that

when the stock market takes a

real bear, the precious metals may also get hammered. But the breakout on the gold chart above is more

than just a positive technical

signal. It represents a major positive move in the making for the anti-bubble and as such, a negative

one coming for traditional

bubble beneficiaries.

Here is

the work done so far by gold

vs. the S&P 500. It's been a hard move up within the intact daily chart downtrend. So the trend is

still negative, but this is the

work (a break through the downtrending SMA 200) that would need to be done to begin a narrative about a

trend change (and the end of

the bubble macro).

Gold is even stronger lately vs. global stocks (ex-US). The

trend is neutral after a

massive spike upward for the monetary metal in relation to global stocks.

These

things take time, patience

and perspective. But the process is moving forward toward a coming economic bust and counter-cyclical

environment. That is what gold's

major breakout is signaling. We are and have been tracking the process every week in NFTRH.

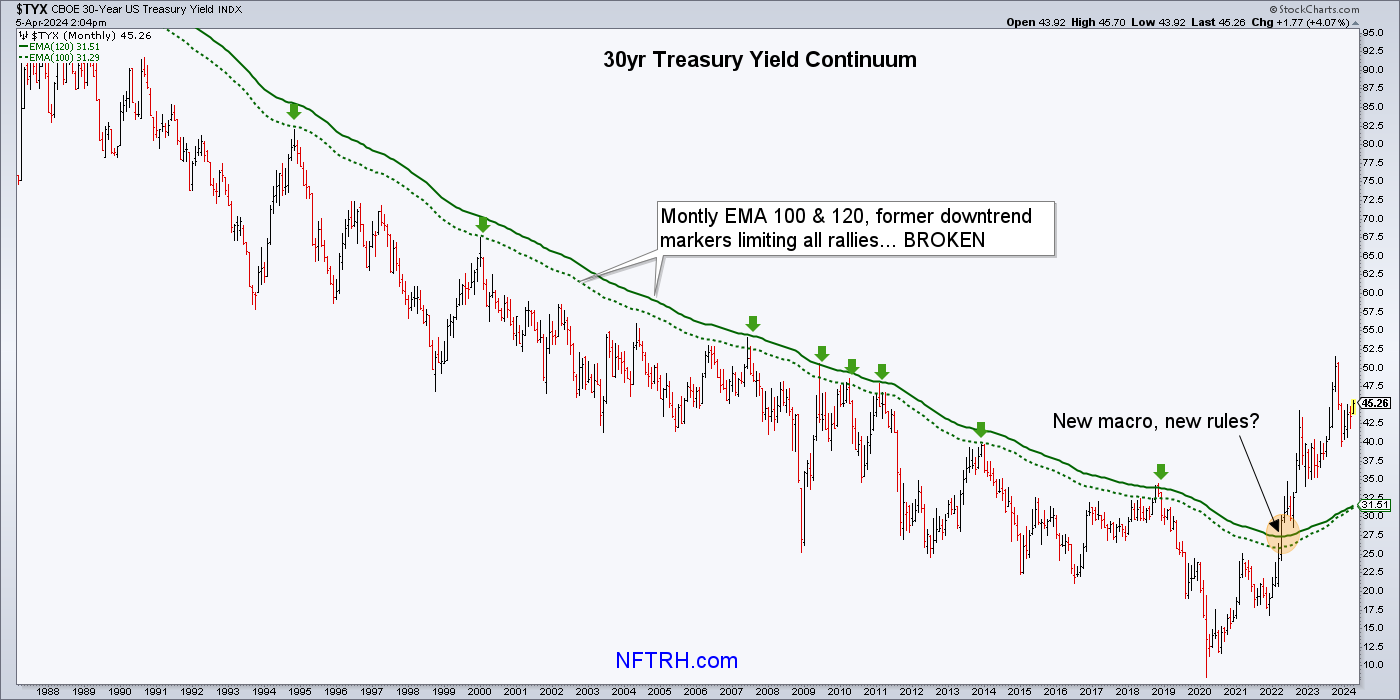

It's time folks. It's

time not be thinking as most have been trained to think over the last two bubbly decades. So says the

Continuum above, and many other

indications beyond the scope of this article.

Email

us

Email

us