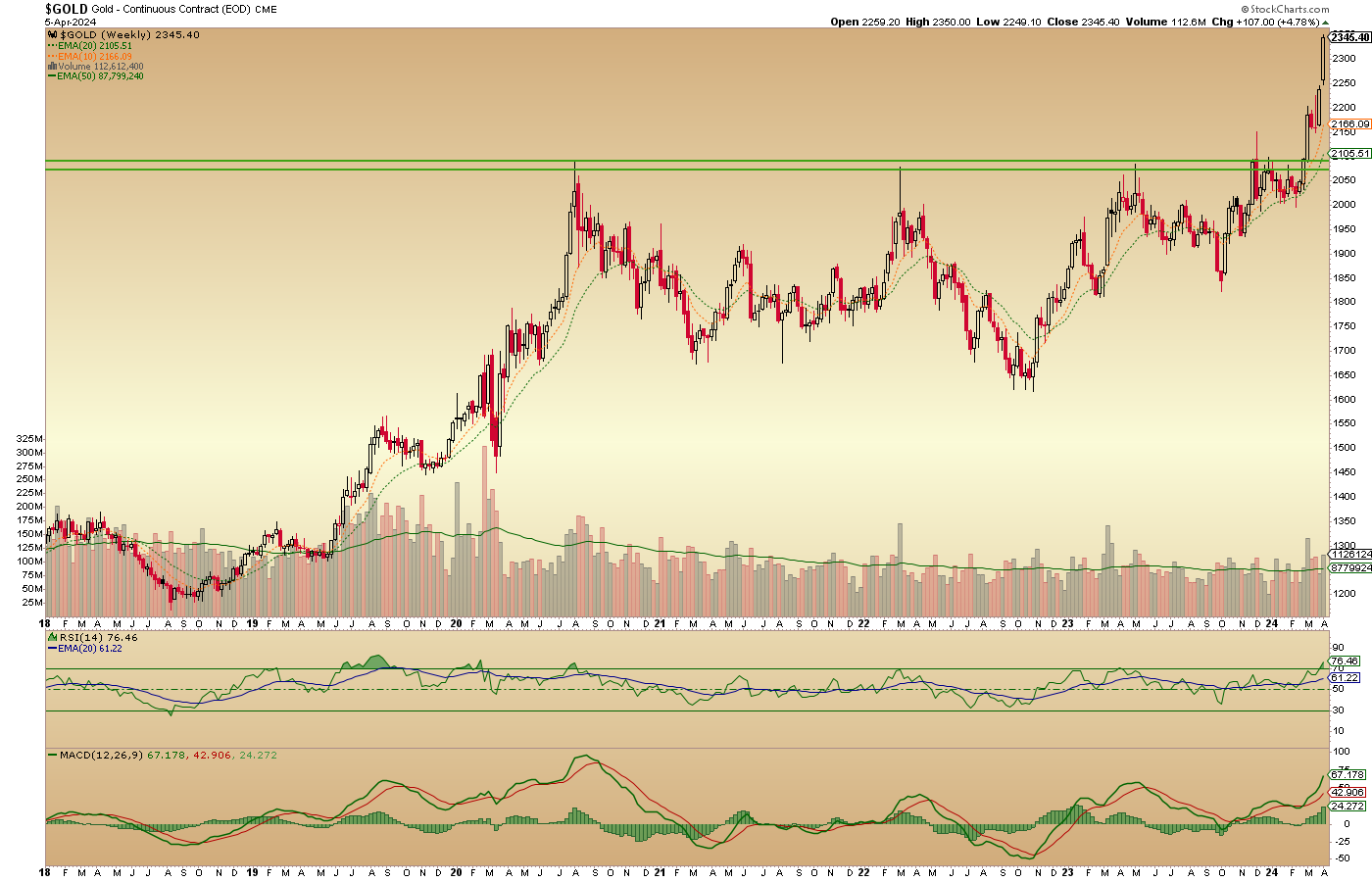

Gold's Long-Term Bull Spikes Higher

An overbought market is a bullish market...

NFTRH is a top-down macro entity, writes Gary Tanashian in his Notes

from the Rabbit

Hole, posting this just before

gold's late-Friday surge and then drop from $2400.

It is not a stock pick rag,

a technical analysis junkie, a

market psychologist or a monetary/fiscal policy obsessive. It is all of those things, as needed. But

primarily what we do is define

the macro and then continually update the definition because it is always progressing, shifting, cycling

and changing.

From that work we then try to take it from 'top-down' definition and apply it to investment

strategies.

I sometimes bristle at the hype that emanates from the precious metals sphere coming in the

form of gold bug doctrine,

perma-cheerleading, lecturing and rigid thinking. That is because – like it or not – the macro is always

shifting and, doctrine or

not, the macro shifted away from the precious metals in 2012 and only began recovering a gold-positive

view in 2018.

Since then it's been a volatile process with incomplete macro fundamentals. Incomplete, but

now turning to the preferred

macro that a gold bull would want to see and a stock bull would not want to see.

Let's be clear, "turning" is

not "turned". It is not complete, but our view of transition is being proven out slowly and now,

methodically. I still have a personal

question as to whether the forces of bubble-making (now in their 3rd decade by my estimation) can hold

'er together to and through the

presidential election.

But we don't need to have the answer to that question.

We need to manage risk and

respect market signals and TA.

Here is the thing; gold to me is an indicator as

much as it is a monetary

value retainer and risk manager. I disregard views of gold as some kind of play; as a market among other

markets.

Gold miners are a play; a play on the asset that stands outside of the Keynesian

debt/leverage system as the anti-bubble.

When anti-bubble forces become too strong and the 'bust' end of the boom/bust cycle ensues, the gold

miners should leverage the

relative performance of gold to speculative upside based on positive leverage, just as they have

chronically under-performed due to

negative leverage during intense bubble phases.

Getting off the idealist views

and back to the technical

view, gold's weekly chart is purely bullish. The pattern of this chart targets 2450. This is a purely

bullish breakout to blue

sky.

The monthly chart advises the target of the large Cup and Handle, which has been fashioned

over 10 years of pain and

pleasure. The max pleasure point had been the 2020 high, from which the Cup made its higher right side

high. After that, the smaller

pattern did its thing.

You see weekly and monthly RSI flirting with overbought

status (as is the daily), but

let's discuss this for a moment.

Traders will watch that stuff. But investors

should realize how long gold

stayed overbought during the hard up phases of the previous bull market (2005-2011) and the first up

phase of this bull market

(2019-2020). I've shaded those instances.

The thing is, an overbought market is

a sign of a bullish market.

I, who have held the metal since 2002, would not trade it (unlike the miners). But traders would do

whatever the hell they will with

GLD and other bullion holders/price trackers.

As we've been noting for months now, gold is bullish

on all time frames, with the daily finally joining the weekly and monthly in that status back in Q4,

2023.

There will be breathtaking ups and gut wrenching downs. But a turn in the macro will put a relative

tailwind to the ups for

counter-cyclical gold in the coming years. It will require a balanced view with ongoing perspective

review.

Email

us

Email

us