Market Highs? All About the Pivot

Fed hiked rates, yet policy loosened...

The FEDERAL RESERVE began kinking its monetary hose two years back,

writes Brian Maher in The Daily Reckoning.

This it did through fevered interest rate elevations and quantitative

tightening.

Yet the stock

market put out its tongue, placed its thumbs in its ears and wiggled its fingers in Mr.Powell's

face.

It has

gone streaking to record heights – despite the Federal Reserve's kinks.

A

conundrum! Or is it?

We are informed that financial conditions are presently extravagant.

They are among the loosest

in several decades. Simon White of Bloomberg:

"Monetary policy remains

exceptionally loose given one of the

fastest rate-hiking cycles seen....policy overall remains very loose despite over 500 basis points of

rate hikes....

"Standing back and looking at the totality of monetary policy in this cycle, we can see

that – far from conditions

tightening – we have instead seen one of the biggest loosenings of them in decades."

Is it evidence you seek?

Then it is evidence you shall have:

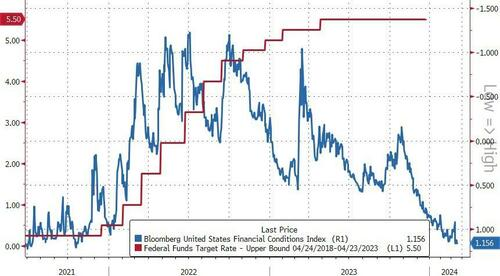

The steeply ascending

red represents the Federal

Reserve's target rate.

The largely descending blue represents financial

conditions as Bloomberg gauges

them.

The Federal Reserve has undertaken four rate elevation cycles within the

past 30 years.

None has yielded a greater financial loosening than the present cycle.

How do you explain

it?

Here Joe Weisenthal and Tracy Alloway – they of the Odd Lots newsletter –

hazard an attempt:

"It certainly feels like there's a pattern where the mere whisper of rate cuts sparks

easier financial conditions (as

markets rally), while hawkish moves seem to do hardly anything....

"As Viktor

Shvets over at Macquarie put it

this week: 'Any hint of the Fed considering an even minor pivot significantly eases financial conditions

while a more hawkish tone

only barely tightens'."

We believe there is justice here.

Further disentangling this

perplexing knot – perhaps – is a certain Stephane Renevier.

"Interest rates

aren't the be-all and end-all of

financial conditions. Yes, higher rates generally mean pricier loans – but there are a whole lot of

other factors that affect how easy

or tough it is for firms and everyday folks to get financing and keep the economic show on the

road.

"Think

about the cost for companies to borrow (credit spreads), how well the stock market is doing (that's

another source of financing) and

how strong the Dollar is (a weaker Dollar means cheaper loans for people around the world who take on

debt in greenbacks, pumping more

cash into the global economy).

"Since the end of last year, all those factors

have turned more positive and

have offset the US' towering interest rates, making financial conditions looser, not

tighter."

The stock

market ebbs and flows with shifting financial conditions....as the tide ebbs and flows with the moon's

shifting humors.

Is it a wonder – then – that the stock market has ebbed with the ebbing financial

tide?

We

hazard it is no wonder whatsoever.

For financial conditions are as loose and

lax as a harlot's virtue – if

not looser and laxer.

Yet the Federal Reserve believes it has guarded its own

virtue with fantastic

ferocity.

It believes its anti-inflationary whim-whams have choked financial

conditions nearly to death.

Mr.Powell at the FOMC press conference:

"We think financial conditions are

weighing on the

economy."

Has this fellow trained his eyes upon the figures?

We must conclude he has

not. Or – or – he is aware of them and intends to depress rates regardless.

For

what purpose....we are

reduced to speculation. We do not know.

This we do know:

Wall Street heavily expects

the Federal Reserve to soon execute its cherished pivot – perhaps in June.

And

we believe Wall Street is

correct. The Federal Reserve will soon commence its rate-depressing campaign.

And so a question rises into

air:

If financial conditions are lenient while rates have taken an extended

hike....how much more lenient

will they be once the Federal Reserve depresses rates?

Will they rocket the

stock market to truly cosmic

heights? Will they kindle inflation's flames?

The above-cited

Renevier:

"Since

easier financial conditions are like steroids for the economy, and inflation is a result of stronger

economic growth, it makes sense

that investors are expecting inflation to rise again.

"Now, that does go

against what the Federal Reserve

says it's trying to achieve – ie, keeping inflation around its 2% target. And if the central bank does

cut interest rates three times

this year, as it suggested just this week, that could lead to even cushier financial conditions – and

further stoke the risk of an

inflation comeback."

We contest the claim that inflation is the consequence of

economic growth. We

nonetheless permit the case to proceed....

"These policymakers are betting that

inflation will dial down as

the job market cools, and are probably expecting those other factors (credit spreads, the stocks' rally

and Dollar weakness) to mellow

out too – all of which could take some heat off inflation. But at the same time, they're also placing a

wager on stronger economic

growth. It's a razor-thin line they're trying to walk.

"And in the meantime,

we're in a weird spot: economic

growth picking up, inflation flirting with a comeback and financial conditions easing way more than

you'd expect, given where interest

rates are. That mixed vibe is why oil and copper prices are on a tear (they both like strong growth and

a whiff of inflation), why

gold and Bitcoin are hitting it big (they're the cool kids when financial conditions loosen and

inflation flexes) and why stocks are

smashing it against all odds (they thrive on robust growth and easy money conditions, and aren't overly

bothered by

inflation).

"We might not be in this peculiar position for long: Inflation

could turn the heat way up, and

put financial conditions into a deep freeze, and all of that could put a damper on growth.

"But for now, the

party's on."

What will Powell and mates do then?

Yet

then is then and now is

now.

Indeed....for now....the party is on, because the Federal Reserve is this

party's host.

We do not trust its management of the liquor that sustains it. We hazard the

attendees....presently thrilling to

alcoholic excitements....are in for one royal hangover.

Email

us

Email

us