US Recession Warnings Multiply

Fed rate cuts can't start soon enough...

The U.S. ECONOMY could be heading into choppy waters, and investors may

be wise to buckle up, says

Frank Holmes at US Global Investors.

Recent data suggest that

storm clouds could be gathering,

with declines in US manufacturing, a softening labor market and worrisome signs from the bond market all

pointing to possible trouble

ahead.

Manufacturing production signaled a significant weakening in demand in

August. The S&P Global US

Manufacturing PMI posted a reading of 47.9, its lowest level in 2024 so far. Any PMI below 50 indicates

contraction, and this is now

the second consecutive month of declines.

Weakness in manufacturing isn't just

a concern for the stock

market. The industry is contracting at a time when Kamala Harris, the incumbent-party presidential

candidate, is hoping to run on the

administration's economic success.

If Harris

takes office at a time when the

business cycle is faltering, she'll face an uphill battle with a slowing jobs market, lagging home sales

and a Federal Reserve caught

between a rock and a hard place on interest rates. Geopolitical risks also continue to swirl in the

background, creating even more

uncertainty.

But the US isn't alone in this struggle. In August, the J.P.Morgan

Global Manufacturing PMI fell

to 49.5, an eight-month low. Out of 31 countries surveyed, 18 showed deterioration in manufacturing

conditions, including those in the

euro area and Japan. The slowdown isn't confined to our shores – it's a global issue that could have

ripple effects on trade, jobs and

investment opportunities.

The US labor market has long been a source of

strength for the economy, but it,

too, is starting to send worrying signals. August's jobs report was underwhelming, and while the

unemployment rate is still relatively

low, the trend is going in the wrong direction.

In July, the unemployment rate

ticked up to 4.3%, which

triggered what's known as the Sahm rule, a little-known but highly accurate recession indicator named

after former Fed economist

Claudia Sahm. The rule has successfully predicted every US recession since 1970, so when it's activated,

people take

notice.

Payroll gains have also slowed over the past several months, and many

economists expect that we'll

see downward revisions in the number of jobs added. All of this is happening as inflation remains a

persistent thorn in the side of

policymakers, complicating the Fed's job as it tries to balance controlling prices with avoiding a

deeper slowdown in the

economy.

Sahm herself has expressed concern that the Fed might not be acting

quickly enough to avoid a

recession. "The Fed can no longer afford to move gradually," she said recently in an interview with

Goldman Sachs. "Twenty-five basis

point cuts would probably suffice to avoid the worst possible economic outcomes, but these cuts have to

be delivered decisively, not

gradually."

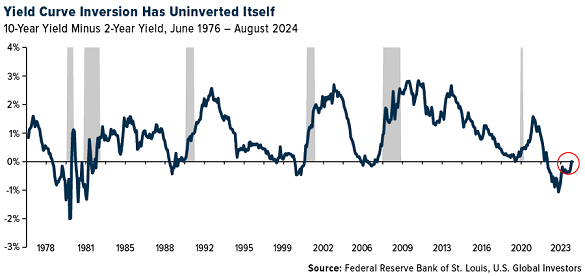

One of the most reliable recession indicators over the last 50

years has been the yield curve,

and last week, it turned positive again for the first time in over two years. An inverted yield curve,

where short-term rates are

higher than long-term rates, has preceded every US recession since the 1970s. This occurs because market

participants, anticipating

future rate cuts to combat a downturn, drive long-term rates lower.

Typically,

the spread between the 10-year

and two-year Treasury notes is used to gauge this inversion. Before last week, the yield curve had been

inverted for a staggering 783

consecutive days, the longest such period in US history. Although the inversion has recently

"uninverted", meaning long-term rates are

no longer lower than short-term rates, the damage may already be done.

Historically, there's been about a

12-month lag on average between the first inversion and the onset of a recession. But this can vary. For

instance, the curve first

inverted in January 2006, roughly two years before the financial crisis began in 2008. If history is any

guide, the prolonged

inversion we just experienced could be setting the stage for another economic downturn.

What does all this

mean for investors? According to Peter Berezin, Director of Research at BCA, it may be time to rethink

your portfolio strategy.

Writing in the Financial Times, Berezin says that now may be the moment to rotate out of stocks and into

bonds. For the last two

years, stocks have been the place to be, but with a recession potentially on its way, Berezin believes

bonds will soon offer a better

risk-reward balance.

In a recessionary scenario, Berezin expects the S&P

500's forward price-to-earnings

ratio to fall from 21 to 16, with earnings estimates dropping by 10%. This would bring the S&P down

to 3,800 – an almost 30%

decline from current levels. It's a sobering prediction, but one that can't be ignored, especially given

the headwinds facing the

global economy.

The Federal Reserve has been in a rate-hiking cycle for over

two years now, but with economic

data weakening, many expect that rate cuts are on the horizon. The first cut is anticipated to come at

the September 17-18 FOMC

meeting, with a reduction of 0.25% to 0.50%. While some might hope that this will stave off a recession,

it's important to remember

that rate cuts take time to filter through the economy.

There's also the risk

that the Fed could be too slow

in its actions. Sahm, Berezin and others argue that decisive cuts may be necessary to avoid the worst

outcomes. The longer the Fed

waits, the harder it will be to reverse the course of a slowing economy.

As

always, I remain optimistic about

the long-term potential of the US economy, but the short-term outlook is uncertain. Now may be the time

to reexamine your portfolio

and prepare for the possibility of a slowdown. History shows that recessions are an inevitable part of

the business cycle, but they

can also present opportunities for savvy investors who are prepared.

Stay

focused, stay informed and as

always, happy investing!

Email

us

Email

us