China's Loss, Mexico's Gain

China no longer No.1 supplier of goods to USA...

A LITTLE OVER a year ago, the world watched as China reopened its doors

after three long years of

strict pandemic lockdowns, writes Frank Holmes at US

Global Investors.

Expectations were high for a robust economic

recovery, fueled by pent-up

demand and consumer spending.

The reality has been starkly different. Despite a

bustling travel season around

China's Lunar New Year – with a record 9 billion domestic trips expected, 80 million by air – the

anticipated economic rebound has

largely failed to materialize, even as world markets have surged to record to near-record

highs.

This

downturn appears not to be just a temporary blip, but a sign of deeper structural issues within the

Chinese economy. The nation's

gross domestic product (GDP) reportedly grew 5.2% in 2023, an admirable print at first glance, but it

masks underlying challenges. A

closer look reveals a significant slowdown from the pre-pandemic era of consistent +6%

growth.

Select

industries such as electric vehicles (EVs) saw remarkable sales in China last year, but this strength

hasn't been enough to offset

serious weaknesses in other sectors, particularly real estate, which remains a major drag on the

economy.

Our decision to close the China Region Fund last year was a move predicated on recognizing early signs

of these economic challenges.

It's a decision that, in hindsight, has been vindicated.

The ongoing property

sector slump and regulatory

uncertainties have further exacerbated investor apprehension, leading to a significant outflow of $68.7

billion in foreign direct

investment (FDI) for the first time since 2018.

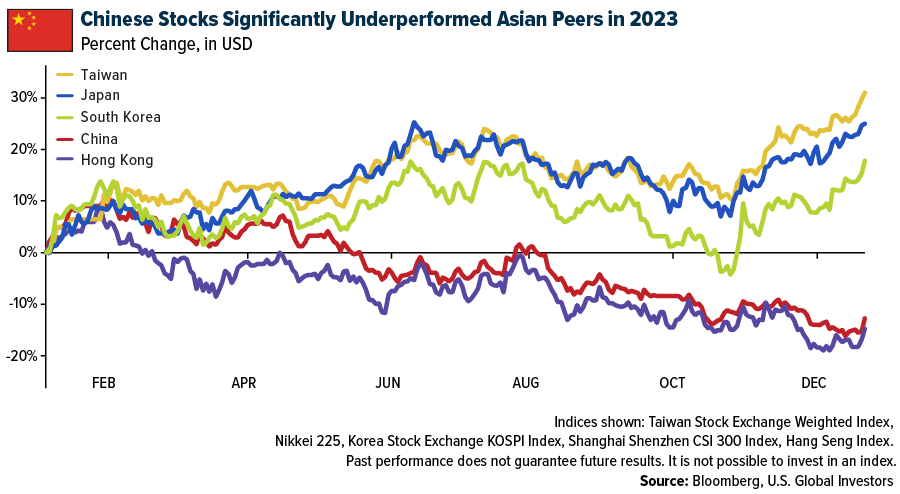

Chinese equities continue to

underperform. Both mainland

stocks and those listed in Hong Kong ended 2023 with losses, even as other Asia-Pacific markets rallied.

Remarkably, Japan's Nikkei

225 is poised to hit a new all-time high after 34 years.

This year isn't off to a great start for

Chinese stocks, either. The CSI 300 shed over 7% in January, while the Hang Seng lost over

9%.

"China seems

to be divorced from the rest of the world," Steve Sosnick, chief strategist at Interactive Brokers, told

Bloomberg. "Part of the lack

of equity response is that the global economy is doing OK without China."

Indeed, in a shift not seen in over

20 years, Mexico outpaced China last year to become the top supplier of imports to the US This change

highlights the escalating

strains between Washington and Beijing, alongside American initiatives to source more goods from closer,

more allied

nations.

Recent data

from the Commerce Department

indicates that imports from Mexico to the US increased nearly 5% from 2022 to 2023, reaching over $475

billion. Conversely, the import

value from China saw a sharp decline of 20%, falling to $427 billion.

Efforts

to stabilize the Chinese market

have so far failed to lift investor confidence. Last Tuesday, the China Securities Regulatory Commission

(CSRC) announced plans to

halt the practice of brokerages borrowing shares to lend them out and to limit the scope of what's

referred to as the securities

re-lending market, in a move aimed at reining in short-selling activities.

This

came a day after the

regulator vowed "zero tolerance" against short sellers, warning them they could "lose their shirts and

rot in jail," according to

reporting by Reuters.

These regulatory steps were introduced after the Chinese

government declared in October

2023 that it would issue 1 trillion Yuan ($140 billion) in Chinese Government Bonds (CGB) to support

local government finances and

fund infrastructure projects in areas affected by natural disasters over the past year.

The move was meant to

send a signal to global markets that China is "pro-growth" again, but as Morgan Stanley's Schuyler

Hooper writes, the strategy is seen

as "merely a repeat of China's old policy playbook, where they rely on investment to prop up 'economic'

growth, while growth in

consumption, export, property and private investment remains sluggish."

The

risk, Hooper points out, "is a

short-lived cyclical rebound amid a longer-term secular slowdown" in the Chinese market.

The Chinese

government faces a daunting task in addressing the deep-seated issues within its economy. Chaos in the

real estate market, local

government debt and deflationary pressures are significant hurdles to sustained growth. Geopolitical

tensions add another layer of

complexity.

The situation serves as a reminder of the importance of

diversification and the need to remain

agile. I believe it's more important than ever to rely on sound investment principles and a diversified

portfolio.

Email

us

Email

us