Platinum 2023 Deficit vs. Price

Platinum price has responded to big deficits in the past...

ESTIMATES of platinum above-ground stocks appear sufficient to balance

forecast market deficits, but

the portion available at current price levels is key, says the World

Platinum Investment

Council.

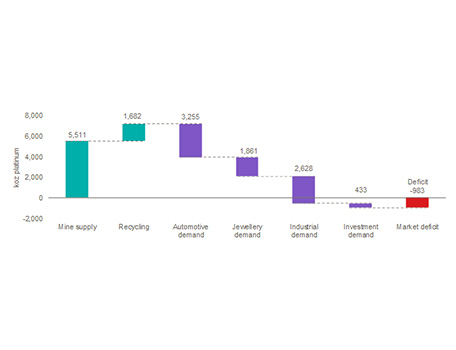

Our latest supply and demand data forecasts a record

platinum market deficit of almost

one million ounces in 2023. The deficit is a result of strong 28 per cent year-on-year growth in demand,

in combination with a

constrained outlook for supply, down one per cent year-on-year.

Moreover,

looking out to 2027, WPIC predicts

consecutive and deepening annual deficits supported by continued demand growth, in particular automotive

demand. Given there is

limited scope for mine or recycling supplies to increase to cover these shortfalls, they will have to be

met from Above Ground

Stocks.

WPIC defines Above Ground Stocks as the year-end estimate of cumulative

platinum holdings not

associated with physical platinum held by exchanges, exchange traded funds or working inventories of

mining producers, refiners,

fabricators or end-users.

This definition is intended to specifically isolate

the unpublished vaulted

platinum holdings from which a supply-demand deficit can be readily supplied, or to which a

supply-demand surplus can readily flow.

The flow of this metal is how the market clears or balances at spot metal prices.

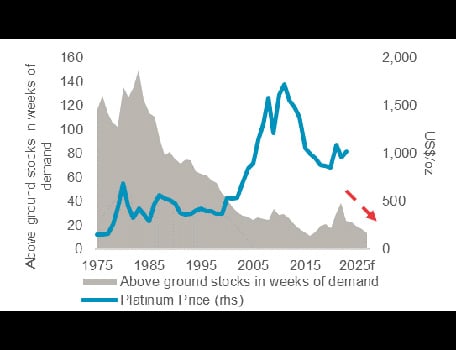

As at the end of 2022,

platinum Above Ground Stocks were estimated to be almost five million ounces – at first glance more than

enough to cover this year's

shortfall and those out to 2027. However, this level only equates to 39 weeks of annual demand and is

expected to fall steeply over

the next few years, absent any material changes to supply-demand fundamentals. In addition, significant

platinum imports into China in

recent years have resulted in around 80 per cent of the estimated Above Ground Stocks being owned there,

effectively unavailable to

the rest of the world due to export controls. Consequently, WPIC estimates that Above Ground Stocks

available in the rest of the world

will be at a level commensurate with only six weeks of demand by the end of 2023.

Typically, when Above Ground Stocks either become depleted or are not 'for sale' by owners at the

prevailing price level in the spot

market, and are hence unavailable to balance market deficits, the commodity price would be expected to

increase to a point sufficient

to either attract new supply into the market, or to cause a decline in platinum demand.

In the case of

platinum, the likelihood of a supply response to higher prices is extremely low. South African mine

supply is subject to long

lead-times for new production and is currently facing operational challenges due to electricity

shortages. In addition, supply from

Russia, unlikely to respond to higher prices because it is produced as a by-product of nickel mining,

has downside risk due to mine

equipment and technology-related sanctions resulting from Russia's invasion of Ukraine.

Furthermore, as

platinum is mined from polymetallic deposits containing other platinum group metals and base metals,

there is a limited ability to

flex production based upon the pricing of any one individual commodity.

The

platinum price has responded

positively to meaningful deficits in the past. It will be interesting to observe its response to ongoing

market tightness as the

current scenario unfolds, especially should security-of-supply concerns materialise, prompting end-users

to add to buffer inventories,

further adding to the platinum shortage.

Email

us

Email

us