Gold Stocks: Not Yet Unique

Wait for it, wait for it...

MANY gold stock traders will hold for the wrong reasons, sell for the

wrong reasons, and not buy back

for the right reasons, writes Gary Tanashian in his Notes from the Rabbit

Hole.

It

is one of the most interesting aspects of precious metals investing/trading. This 'buy/sell for the

wrong reasons' phenomenon. Many

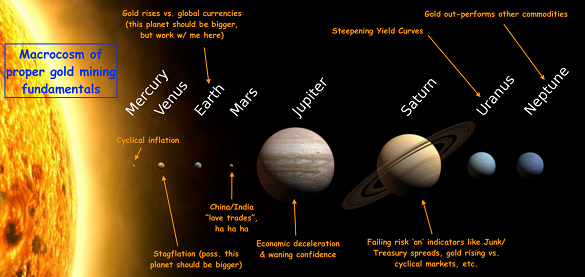

years ago I came up with the graphic below to illustrate how advisers, analysts and their herds focus on

the wrong reasons for being

bullish on gold miners.

Re-enter the Macrocosm...

...our rough guide to what is

and what is not so important to the fundamental gold mining case.

See those

tiny planets (China/India love

trades and especially, cyclical inflation)? They are tiny for a reason and that reason is that they are

bullshit, where supposed

fundamentals are concerned.

What I call "cyclical inflation" – that is,

inflationary macro management by

monetary authorities that at least temporarily works to benefit the economy – and the China/India buying

promos have been ineffective

themes at best, and disastrous at worst, for gold stock traders who believe in them, since

2008.

As belabored

for many years, it is counter-cyclicality and deflationary pressure that will drive gold's "real" price

(measured against commodities,

stocks, CPI, etc) up hard, even if its nominal price remains under wraps. That will be the real monetary

value asset retaining value

as its relative price gets marked up within a failing macro.

That, in turn,

will expand the margins of gold

mining operations, all other things being equal. Gold/Energy, Gold/Materials, Gold/Humans, etc. As

gold's ratios to other assets and

markets expand, so does the bottom line potential of a gold miner.

For much of

the last two decades, the

above-noted dynamics only came into play during asset market bears and/or crashes (eg, 2000, 2008, 2020)

before the deflationary

situation was quickly mopped up by people like our nation's "hero" Ben Bernanke, circa

2008-2009...

It was

truly heroic – if long-term damaging to the system – as the bull market in stocks birthed by a steroidal

policy panic begun in 2008,

endures to this day.

Do we have proper gold mining fundamentals in line today?

Well, gold's ratios to

cyclical markets are grinding into place quite nicely. The monetary metal is firmly trending up vs.

commodities per this weekly

chart.

That feeds

what I call gold mining "sector" fundamentals. However, there is a vulnerability in gold stocks to a

future broad stock market bear,

as there is not yet a definitive change in trend vs. stock markets and the miners are merely among the

leaders of a wider rally,

including many highly speculative asset markets.

The gold miners are not yet

unique. And that is okay, for

now. But there is likely to be a "SELL" call on the sector at some possibly much higher level than

today's.

That will be due to broad market correlation and vulnerability. Recall gold stock traders puking en

mass, leading the market crash in

2008 because "failing inflation!!", because "deflation!", because "OMG, gold is dropping!"

But in relation to

cyclical and inflation-sensitive markets gold rammed higher during the last two deflationary episodes,

in 2008 and 2020. Those were

times to buy, as mining stocks crashed.

You can bet that inflation-centric gold

bugs were puking out

because..."OMG, no INFLATION!"

A

future long-term bull market

may result from the lack of future 'unsuccessful' inflation operations (unlike the 2004-2022 period).

But again, first comes the

"vulnerability" theme, after whatever highs are made on the current bull leg (we manage upside targets

and interim caution/opportunity

points reliably and effectively each week in NFTRH).

The "macro" fundamentals,

which will influence

mainstream investors when gold reasserts vs. stock markets, are still in progress, baking in the oven.

The above-noted "sector"

fundamentals are doing quite well, as gold handily out-performs cyclical commodities, including gold

mining cost drivers.

The fundamental situation is positive now, and will improve after stocks (likely including

gold mining stocks) top out.

Then will come the longer bull market that could run through the rest of the decade (just riffing

here).

The

crux of our current big picture macro theme is that the implications of a broken macro, per the 30yr

Treasury Yield (Continuum's)

broken long-term trend, is that our policy heroes may and probably will try to effectively reflate the

system, but due to saturation

of the bond market (the Fed's decades-long management/manipulation tool), the results will not be the

same happy ones that the Hero

above was able to provide.

There is a rebellion by the carriers of the massive

debt of the USA and it will

impair a formerly all-powerful Fed's ability to control things at will on future down cycles. This was

the old way...

The Outer

Limits, adjusted for today by

Notes from the Rabbit Hole

...but ineffective battles against both deflation

and inflation, a veritable

pulling back of the curtain of invincibility, may be the new way.

As to the

Continuum, the trend is broken,

but "yields are declining now", you say? Yes, and right on schedule per our analysis of a

disinflationary (Goldilocks) to deflationary

macro swing we have been managing for nearly 2 years now. The implications of the Continuum's trend

break would come into play after

this pullback to test the breakout plays out (targeting the 3.3% area).

So I am

talking my book and as NFTRH

subscribers know, that book calls for this easing of inflationary pressures in the current phase, but

also future policy constraints

when it is time for whatever "Hero" is in charge to spring into action against deflation.

For several reasons

that are beyond the scope of this article, I expect a tragic ending to the stock market arm of the

"Everything Bubble" instigated by

hyper-easy policy. Anything correlated positively with it is likely to be vulnerable when the machines,

quants and multitudes of wise

guys start selling in unison, just as they buy in unison today.

Oh, and don't

forget the margin man. He will

want his due, and he won't care what you have to liquidate to get it.

But on

the big picture, the much

bemoaned HUI/Gold ratio (HGR) as been a righteous indicator of a generally poor gold mining fundamental

backdrop.

Its 20-year decline was logical, and you should not let belly aching and excuse making influence you

otherwise. But thus far the gold

mining rally is valid by this important internal indicator. I expect the HGR to continue leading into

whatever top is out ahead.

Longer-term, after a deflationary liquidation clears the macro, a new bull market in this internal

indicator may even

ensue.

Consider joining NFTRH, which has been right on the mark since

effectively managing the 2020 crash,

the inflationary recovery from that crash, and most recently managing the "new macro" picture and the

current Goldilocks/disinflation

situation within it.

Actually, on the big picture we've been in step with the

markets analytically, since

inception right into the jaws of the oncoming market crash in Q4 2008.

One

thing is for sure. We need to

manage modern markets with an independent mindset and not follow stale and debunked theories about why

the gold stock sector "should

have been" bullish. The HUI/Gold ratio was not wrong. It was very right. If your assumptions are wrong,

then your entire analytical

framework is built on an error.

And the assumption that cyclical inflation was

going to bull gold stocks was

a pervasive, destructive and ongoing error.

The current trade is already quite

profitable, but when it ends

it will likely end in rude fashion, if current trends and market correlations remain intact. Then, amid

deflationary fears upon the

macro, the average gold stock trader will not be buying the destruction. But that will be the time to

position for a longer-term bull

phase. That could be years out from here.

Meanwhile, let's enjoy the current

trade, but also understand it

for what it is, a cyclical bull phase against improving fundamentals with one nagging issue, a currently

positive correlation to high

risk cyclical markets (again, to talk my book, I have several positions in those markets as well, as we

manage the perhaps final

stages of the broad bull).

Email

us

Email

us