Golden Nugget

So much smarter than the other gold bugs...

GOLD is misunderstood, but the misunderstanding extends to those critical

of others for

misunderstanding it, writes Gary Tanashian in his Notes from the Rabbit

Hole.

Because in Wonderland what is, it wouldn't be.

The subject of this post has

been made anonymous, as I've

decided to release it to a wider audience. Said subject anonymized those he was critical of and so,

turnabout is fair

play.

Elliott Wave technical analyst Mr.Anonymous (Mr.A) has an article

explaining his view of why gold is

misunderstood by analysts that claim it is a hedge against inflation and a hedge against stock market

weakness. On the surface, he is

correct. You cannot argue with facts and the facts are that gold has been a less than stellar inflation

hedge (under certain

inflationary circumstances) and it did go down significantly during Armageddon '08 and the 2020 pandemic

crash.

As noted more times than I care to remember, there are far better hedges against inflation

than gold when the inflation

manufactured by policymakers is working, albeit temporarily, in support of the economy. Mr.A is also

correct in noting that gold went

down in the market crash of 2008 and the lesser crash in 2020.

So what is my

beef here?

Well, we have yet another analyst discussing gold as if it were simply an asset among other

assets, focusing on its

nominal performance rather than its long-term value and importantly, its relative value when marked up

or marked down, as the

anti-bubble to most other asset markets, which have been sustained for decades now by a bubble in

aggressive and inflationary

policy-making.

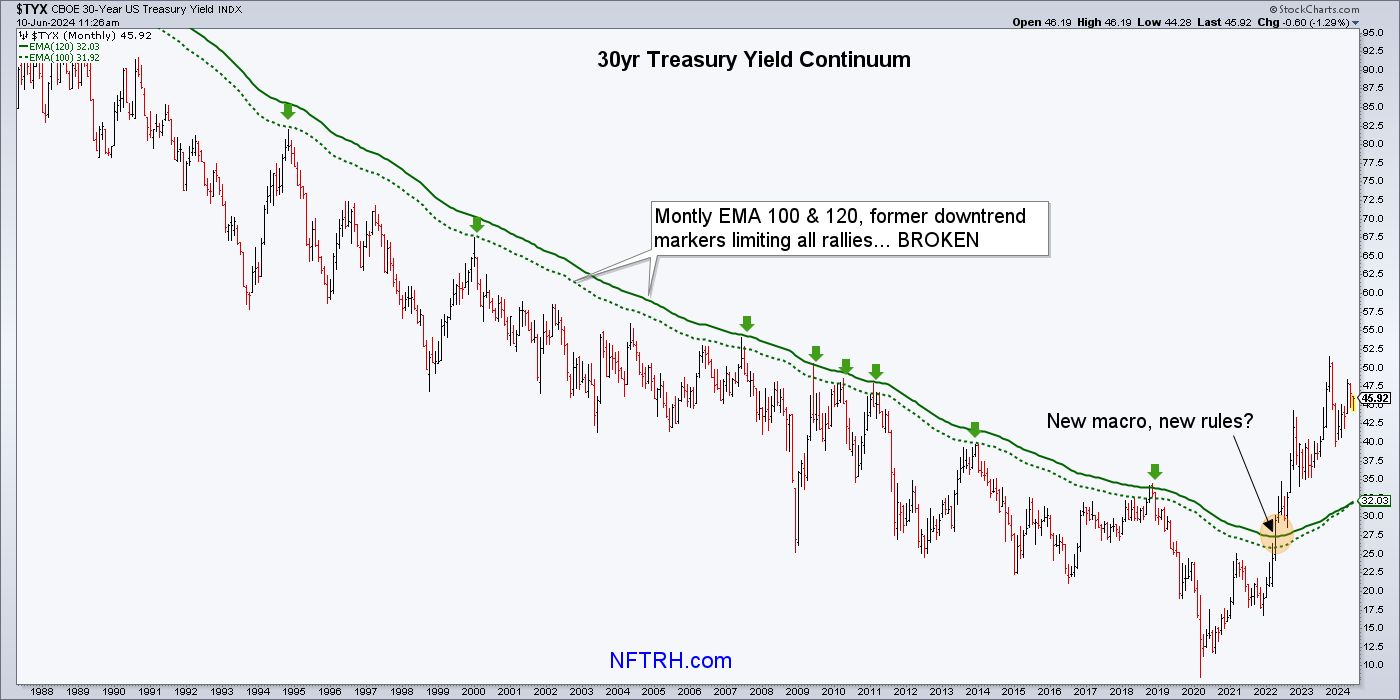

It is a bubble that I believe has ended, although it doesn't

consciously know it yet, with

policy-propped asset markets now little more dead men walking. That assertion is based on several macro

indicators I use, but none are

more visually striking than the decades long trend break in the 30-year Treasury yield

Continuum.

Among other things,

that trend

break implies that the ease with which policymakers were able to inflate the system at every crisis or

even hint of crisis is a thing

of the past.

The sedate bond market signaling gentle disinflation gave license

to inflationary policy at

every sharp downward turn of the Continuum. That ease and simplicity is history now, and hence the odds

have increased that the bubble

is done (although still stumbling forward trying to make its way to or through the US presidential

election with several fiscal

initiatives beyond the scope of this article in play).

But here is the key

point: Gold is the anti-bubble.

Its positive correlation with bubble beneficiary markets since it ended its post-2020 corrective phase

in Q4 2022 is one of two

things: cause for concern about the nominal gold price when stock markets take the next bear, or the

beginning of the new macro as

gold looks ahead to the obvious end of the policy-induced bubble. When stock markets take the bear, I

would not bet on gold merrily

going up.

So there again, on the surface Mr.A is correct. However, it sure as

shootin' will

outperform.

Let's take a few quotes and rebut, shall we?

"I do not have to go

back terribly far in history to prove this premise as being an outright falsehood. First, let's start

with early 2020. As the SPX

proceeded to crash during the Covid outbreak, did gold rally? Nope. Did gold at least remain stagnant?

Nope. In fact, gold proceeded

to drop by 15% during that time. Silver was even worse as it lost almost 40% of its value during that

same

timeframe."

Gold is not supposed to rally in nominal terms during

crises. It is supposed to retain

relative value. This is what gold did in relative terms to SPX during that crisis.

After its

relatively moderate nominal decline, gold led most markets out of the abyss before the inflationary

bailout operations of central

banks and governments set it up for a long correction as cyclical markets regained footing. That was as

it should be for the

anti-bubble.

As for silver, it is not gold. I don't know why it is even

included in this conversation. Silver

is even further from an effective disaster hedge than gold, as it has more cyclical industrial qualities

than gold (although it can be

a better inflation hedge).

Now, if you are still not convinced, well, let's go

back a bit further to the

Great Financial Crisis of 2008. Again, did gold rally during this financial upheaval during which the

perceived "safety" of gold was

sorely needed? Nope. Did gold at least remain stagnant? Nope. Gold lost 30% of its value, which clearly

outlined that you cannot rely

upon gold as a hedge against stock market upheaval.

And, again, silver was much

worse as it lost 60% of its

value during this time.

Gold got

hammered during Armageddon '08

(which for stocks, actually extended to Q1 2009) but in relative terms it rose strongly vs. SPX and

rocketed higher vs. cyclical

commodities like oil and base metals. It then went on to out and under perform periodically as cyclical

inflation manifested out of

the 2008 policy panic and subsequent years of Zero Interest Rate Policy (the financial blight known as

ZIRP).

But, clearly, history did not teach this lesson to everyone, as many completely ignored what occurred

during this timeframe, and again

expected gold to save them during the Covid crisis. And the many that have still not learned this lesson

now come back to

prognosticate that gold will provide safety in the event the stock market turns down.

What is most

interesting is that most of these same folks also maintain a world view that gold will not rally

alongside the equity market. In fact,

I just read another article which outlined this erroneous commonly held view, and claim surprise when it

does rally alongside the

equity market.

The point with gold is its relative performance. Nominally, it

is going to go up or down as

the prevailing winds and varied macro inputs (economic, policy both monetary and fiscal,

inflation/deflation, disinflation,

psychological/sentiment, etc) dictate. But the big picture macro is what is important.

Where has it been?

Where is it going? What is it indicating?

As for the "surprise" of gold being

correlated with asset markets

lately, it is already noted above that gold is either being set up for price pressure when a broad bear

market ensues or it is

diverging to indicate the new macro.

Mr.A goes on to discuss what I have harped

upon for many years, that

gold is not usually an effective inflation hedge, at least during the pro-cyclical previous several

decades. Let's not dig that up

again. Anyone who bothered to look beyond the standard gold bug dogma already knows that. Let's however,

rebut one final

point.

"My friends, at some point, one has to open their eyes and look at

markets objectively. Gold is not

driven by inflation. Nor is it driven by deflation. Nor is it driven by the Dollar. Nor does it fall

when the equity market rallies or

vice versa. Gold is driven by market sentiment. And it is the only constant in the gold market which

allows one to maintain an

objective perspective on the price trend in gold, and be able to prognosticate that trend in any

reliable and consistent

manner."

Gold's case should not be simplified to only sentiment unless we are

discussing the very big macro

picture. While sentiment is an important tool in managing an inherently emotional sector like the

precious metals, it is far from the

only consideration.

Mr.A is writing in linear fashion, as if the decades of the

Continuum's downtrend were

still intact. The gold market going forward will respond to policy initiatives and constraints, economic

acceleration or more likely

in the few years ahead, deceleration. Gold market sentiment is a knock-on effect of what is already

happening. That is what sentiment

is, a tail chasing the dog. The dog being macro fundamentals and technicals.

Notice I did not mention war,

pestilence (the hard post-pandemic correction for gold was in the bag by mid-2020 due to damaging hype),

China/India buying or any of

the other common themes put forth as fundamentals for gold. Boiling it down, gold is about policy and

sentiment. Aside from being a

very long-term holder of real monetary value, gold is a barometer of mass confidence or lack thereof in

policymakers in government and

finance trying to regulate the economy and associated markets to desired and by definition, manipulated

ends.

So yes, gold is about sentiment. But it is about big-picture sentiment on a societal level. That is why

a significant change in the

long-term macro is so important. It is going to feed sentiment on a mass scale in the years ahead. My

rebuttal seeks to add layers and

detail to another analyst's opinion, rather than express outright criticism.

Email

us

Email

us