Gold vs. Inflation Expectations

Let's check this via the mining stocks...

The RELATIONSHIP between gold and inflation is not usually a positive for

gold stocks, but that is

changing, writes Gary Tanashian in his Notes from the Rabbit

Hole.

I want to call your attention to an

article by Jordan Roy Byrne

that provides information on "everything you need to know about gold stocks."

Well, that is one man's

subjective view of the situation, but he is a savvy and well grounded gold market watcher, so the whole

article is worth a read.

However, the last item caught my attention because as you may know, I have spent a lot of time debunking

the well promoted myth that

gold stocks should be bought as protection from or utility against inflation.

Nothing could be further from

the truth when said inflation is manufactured by monetary/fiscal policy and works to the benefit of the

economy before it begins

noticeably impairing the economy. There have been long stretches during which the manufactured inflation

works positively for the

economy.

The proof of the assertions above has been gold's under-performance to

cyclical assets and hence,

gold miners' negative leverage to that performance. It's not rocket science if you stay unbiased. It's

just the way it is and the way

it has been much more often than not during the decades of the Continuum's gentle disinflationary

journey southward. A journey that

was rudely sent off course in 2022.

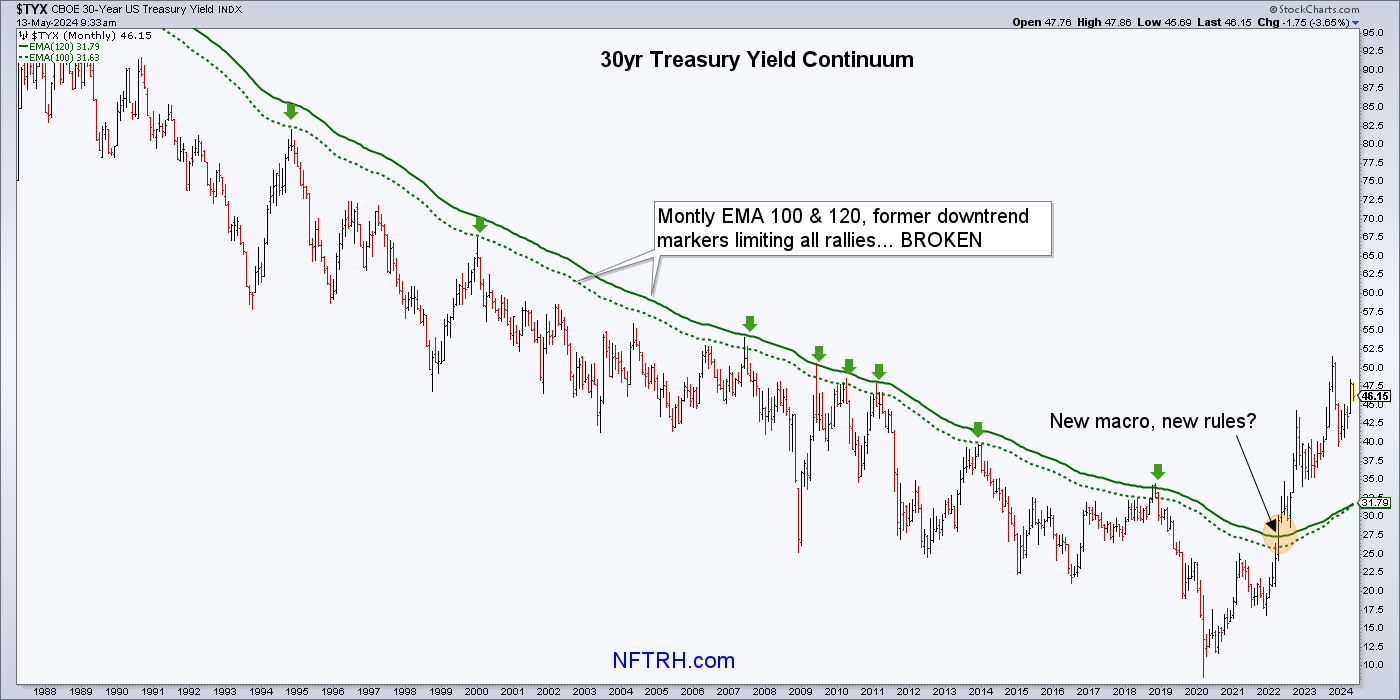

While the 30-year

Treasury yield continuum chart

(among other things, an indicator of an oncoming era of impaired policymaker ability to respond to

financial crises with inflationary

'bailout' policy) tempts me to veer from the post's original focus, I'll stay on track here. From

Jordan's article:

Whether "the best" indicator for gold stocks or merely one of the best, there is no arguing that

Gold/CPI correlates well with the

gold miners.

One indication this chart holds for me is that of a transition

into a counter-cycle as public

fear of inflation (confidence that inflation is here to stay) has peaked but remains intact while gold

creeps the counter-cyclical

environment out ahead (post-election?).

Related to Jordan's chart above, I have

been including this chart of

Gold/RINF (inflation expectations) and HUI, on a much shorter time frame, in NFTRH since we identified

the positive divergence in

Gold/RINF to HUI back in February.

Since then Huey has zoomed upward to close

the divergence. "Inflation

expectations", "CPI"...different flavors of the same general measure of what the public thinks of as

"inflation".

It will be important to keep these gold ratios (vs. inflation) in view going forward to

continue to confirm the oncoming

counter-cycle and as such, fundamentally positive era for gold miners, which will finally start to

leverage gold's relative

performance to the upside rather than the downside.

Email

us

Email

us