Prepping Gold for the 'Post-Bubble'

Stocks keep soaring, miners keep hurting...

The BUBBLE in 'no holds barred' monetary policy (birthed under Alan

Greenspan) and the bullish markets

it benefits are in their third decade, writes Gary Tanashian in his Notes from the Rabbit

Hole.

Gold, meanwhile, will not be ready until the "post" bubble.

This is an article

from a source, yours truly,

who considers it his job to define the 'top down' macro before trying to pick stocks. In other words, it

is important to get the big

picture macro, as well as its shorter-term rotations, right before trying to select stocks and the

sectors they reside in.

In an extreme example, the gold mining sector has been most often impaired by the 'bubble

on' macro, including its

inflationary phases, not helped by it. "Post-bubble" will be a different story. But you can't change the

macro because of 'want'. It

will change when it is good and ready.

In the year 2001 Sir Alan Greenspan was

forced to abandon his stately

"Maestro" image in favor of a more desperate, even panicky version of himself. That desperation was put

into effect by the various

inflationary means used to birth and blow the credit bubble, which launched the real estate/mortgage

bubble and eventually, the great

stock market bull that persists to this day.

This is ancient history

(2003-2008), but it was an important

time when we as market participants were taken down the rabbit hole, whether we liked it or not.

Fittingly, the end of this historical

phase resolved in a righteous market liquidation of Q4 2008.

By then it was Ben

'the Hero' Bernanke's turn to

try his hand at inflationary bubble making, and inflationary bubble-make he sure did. New and unusual

methods of QE/Bond

Manipulation/ZIRP and a new twist on things in order to "sanitize" (the actual word the Fed used back

then) inflation signals out of

the macro, aptly named Operation Twist.

You think this was anything remotely

resembling normal? This 'twist'

not surprisingly came after the Bernanke Fed had cooked up inflationary operations of its own that were

threatening to point a finger

right at these big brained monetary/economic intellectuals that were primary in creating every inflation

problem since

2001.

Inflation begins with money printing by various means. The pure

definition is inflation of money

supplies chasing finite assets. Inflation was turned on like a spigot whenever our remote-controlling

monetary managers wished. Later,

in its effects, come the cost-push inflationary problems like those of the recent cycle.

The Federal Reserve

actually saw the potential for its previous inflationary episodes to get out of hand (Greenspan era into

the Bernanke era) and

concocted a bond market manipulation scheme to paint inflation right out of the picture. And guess what?

The market bought it. Market

players bought it. Lapped it up like dogs. They kicked the 10yr-2yr yield curve into a flattening phase

and Goldilocks flavored

economic boom. That was generally the 2013 to 2019 era generally attended by a strong US

Dollar.

To this day,

the dogs devour every morsel thrown their way and their confidence in our monetary regulators is intact,

by definition. Every time a

still hot economic or inflation signal comes in the market quakes in its boots, and that includes the

anti-bubble, gold. Confidence =

intact. Gold is for when "intact" becomes "unglued".

Hence, the only thing a

right-minded market participant

can do (excluding the vast majority who still think it's normal as their financial advisers continue to

cost average up into nosebleed

territory) is not short it in committed fashion, play it from the long side with risk management, or sit

and collect the cash income

that the Fed is paying you to take advantage of.

As for speculating from the

long side, what has been working

best over the last year is what we originally projected a year ago: the Goldilocks stuff.

A market in full

submission to the Fed's every utterance from its various orifices continues to view 'cost-push'

inflation implied in the January

Payrolls report and even a slight uptick in Manufacturing (we'll take a brief look at the latest ISM in

this weekend's NFTRH report)

with fear of the Fed, which in turn has been driving the US Dollar.

So

confidence is intact, by definition.

Markets are flat out bullish. AI is going to make us all rich (well, I sold SMCI too soon, collecting

only a 70% profit on two

separate trades. Actually, I had to sell SMCI just as I had to sell ANET before it because my DNA

directs me not to be a hype follower

and by extension, anything resembling a committed bubble player.)

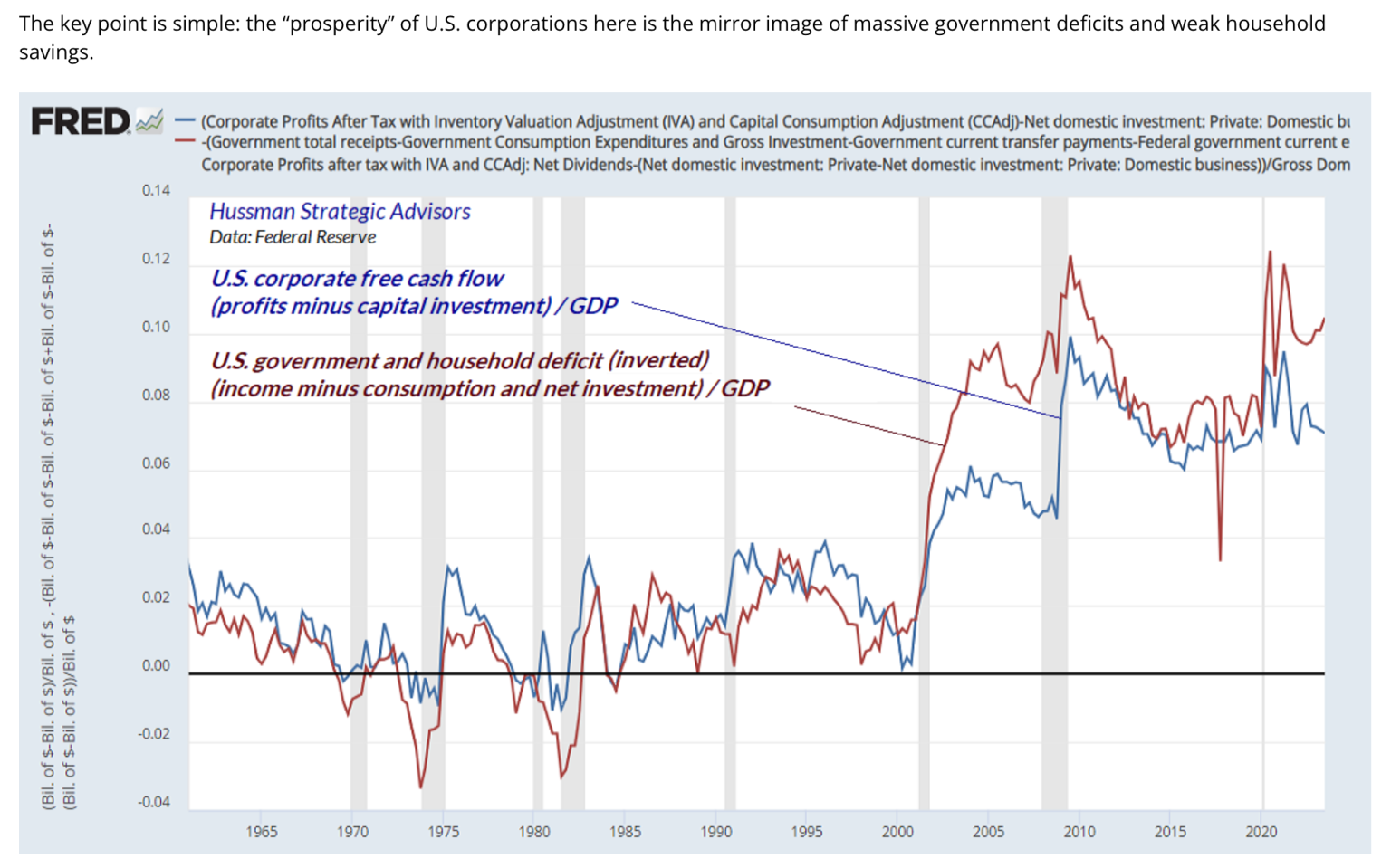

This graph

produced by John Hussman was

taken from a more extensive article, which you may want to check out. Feel free to reference the NFTRH

Links page any time, as you'll

find Doc Hussman and many other worthwhile sources there (market tools, economic data, industry

news/analysis, biased and unbiased

analysis alike, and so much more). I've built that links page for my own reference. Why not bookmark it

for yourself?

Here Hussman illustrates in one picture that our bullish markets and strong economy are the

products of leverage. In an

ongoing bubble this does not matter. In a bursting bubble? Well, it matters.

So the above is a bullish

picture at high risk because it is the product of leverage to a growing debt pile and by extension,

deficits. That is what the economy

and associated bull market are built upon.

Play it if you will, but also

understand it for what it is. For

those submitting to the Fed's every utterance (not to mention to their mainstream financial advisers'

assurances that they are

professionally managing their wealth in the ways of tradition) it's all good...as long as the bubble in

policy and associated markets

and thus, confidence are intact.

Other indicators we use in NFTRH show what we

have been noting for months;

that the market is two things: 1) bullish and 2) at high risk. To save room for more pointed discussion

about individual equities and

strategy in the upcoming NFTRH 796, I'll drop a cavalcade of our indicators in this public article for

subscribers and the public

alike to review.

Again, I want to remind you that the Goldilocks story above is

from a year ago when nobody

else was talking "Goldilocks" and a relative few were talking bullish in general. I point that out

because when I write highly

negative articles like I perceive this one to be, proven credibility (that I've not been a perma-bear,

perma-bug or perma anything

else to this point) is important. I simply have to write about what I see and I don't care whose agenda

it may or may not

serve.

On that note, risk is play in the form of sentiment and in the form of

other indicators like the

extreme low in the defensive Healthcare sector to the broad SPX. The XLV/SPY ratio has historically and

reliably spiked upward into

and during bear markets and hard corrections. The exception was 2012 to 2016, when there was a lot of

Healthcare-related political

noise in the picture. The ratio shows high risk to equities and yet a still bullish

situation.

Speaking of a

still bullish situation, the Semiconductor > Tech > Broad leadership chain has been a staple in

NFTRH, keeping us from

attempting an active bearish orientation and/or keeping us with a bullish view (risk and all). SOX

leading NDX and NDX leading SPX is

the bullish leadership recipe. It's intact, if not yet fully baked.

As for

gold, it is not yet signaling

either a bear market or an illegitimate bull market for stocks.

During the un-shaded period from 2002 to 2011

the stock market spent the majority of the time in an apparent bull market. Stocks were going up! Gold

went up better. Currently,

SPX/Gold shows stock bulls sleeping soundly.

However, the Copper/Gold ratio

shows that aside from the 'strong

Dollar'/Goldilocks stuff, a down economic cycle and stock market bear are just itching to come into

play. Post-election, perhaps? Can

they hold it together that long? NFTRH 795 put on its tin foil hat recently and took a hard look at that

question, both pro and

con.

Meanwhile,

another risk indicator to a still

bullish market situation is the current state of the VIX vs. the bulling SPX. It's not a major thing,

visually. But historically the

VIX has tended to travel at least flat with a positive bias prior to SPX corrections. Today? Well, VIX

is traveling with a positive

bias in defiance of the big bull move in SPX.

We anticipated, if not predicted

a bull move in SPX, after all.

The anticipation was for anything from a slight higher high double top to an upside 'suck 'em in' FOMO

extravaganza and upside blow

off. The market is agitating for the latter now.

Ironically, the recent bump up

in Fed hawkishness could

sustain the bull run in stocks longer than if they had remained stapled to the March rate cut view. It's

when the Fed is finally

compelled to start cutting to get in line with the declining 2yr yield that max bear damage has been

inflicted. I don't say so. The

chart and history say so.

There are many more indicators we use. From Libor

Yields to High Yield Spreads to

Yield Curves and more that are currently telling us the...

Bottom Line (as per

NFTRH for much of the last

year):

The stock market – especially in its headline areas – is bullish

and...

The stock market

is at high risk.

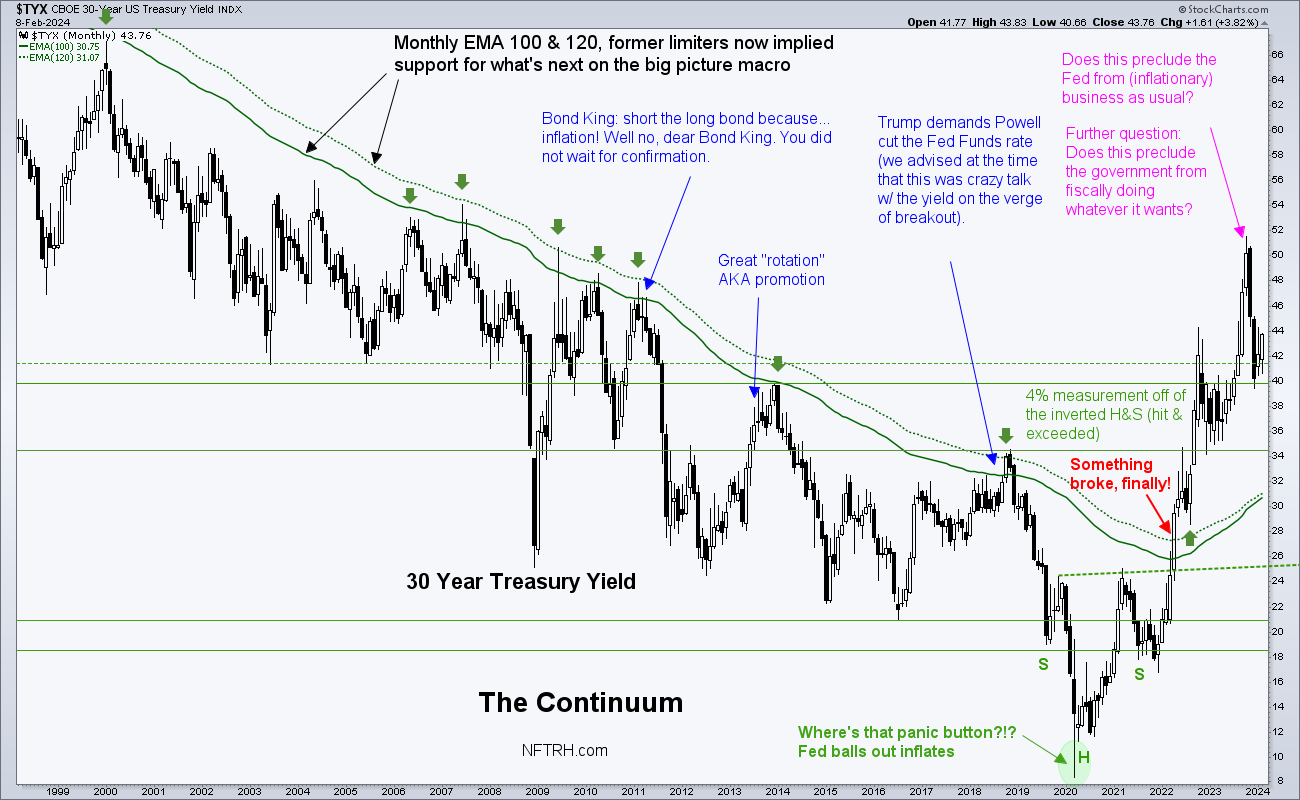

Gold, not mentioned much in this article, nonetheless lays in

wait for the post-bubble. I'll

continue to respect the idea that a major post-bubble indicator kicked in in 2022. That would be in the

in the form of the king of

NFTRH indicators, the 30-year bond yield Continuum, which after years of keeping us aware that

inflationary policymakers were in full

control (the Continuum indicated pleasant disinflation, after all) smashed its limiting moving

averages.

And

you wonder why today's Fed is so zealous about fighting inflation?

"Post-bubble" will be the only macro that will

sustain an extended and potentially epic move in the gold mining industry. Because by then, the gold

mining product's relationship to

cyclical and risk 'on' asset markets will leverage the miners' bottom lines to the upside.

This is the Bob

Hoye playbook, but it's been elusive over the bubble years (decades) and it's still not quite time yet.

Email

us

Email

us