Gold Mania? Wait for $3000

Investors absent, central banks hoarding...

I'VE HAD at least a dozen Uber drivers pitch me on suspect investments,

writes Adam Sharp in

Addison Wiggin's Daily

Reckoning.

For a while, it seemed like every trip came with free, and invariably horrible,

picks.

Interestingly, I've not had a driver, or a barber for that matter, pitch me on gold and silver. Despite

gold regularly breaking out to

new highs, we really haven't yet seen any signs of a typical retail mania.

Looking at Google Trends. There

are no signs of increased investor interest in precious metals. Google search volume for "gold price"

over the last year is showing

barely any movement. Other search terms such as "buy gold online" or "gold etf" – which would indicate

growing interest – are

similarly flat.

Despite solid performance, gold and silver are not yet hot

commodities. A 2023 survey by Bank

of America showed that 71% of financial advisors had a 0-1% allocation to gold. Only 27% had a 1-5%

exposure rate.

Perhaps even worse, only 2% of advisors report a 5-10% allocation to gold.

Madness.

So if

investors aren't snatching up all the gold, what's driving the price up?

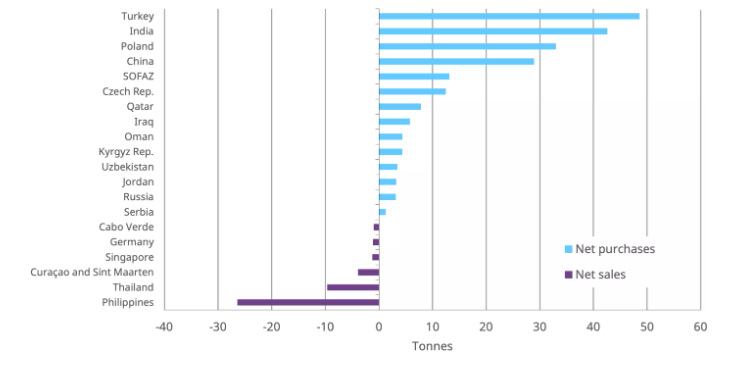

Central bankers are buying in

droves. The chart below shows purchases by country in 2024 through July.

According

to the World Gold Council, central banks added 37 tons in July alone. That's up 206%

month-over-month.

There's no sign of central banks slowing their buying anytime soon. It's also important to note that we

don't have great data on

Russia or China, which could both be buying substantially more bullion than reported.

There's rich irony in

the fact that the primary gold bulls today aren't individual investors, it's the guys running the fiat

printers. This is an insider

buy signal at a global scale. And these aren't fickle day traders in for a quick flip. These central

banks have a new reserve policy,

and it appears to heavily favor gold.

Over the past 75 years, the US Dollar

emerged as the world's leading

international reserve asset. It eclipsed gold in the early 1990s and remains dominant to this day. But

the trend has finally flipped.

Today, gold as a percent of international reserves is climbing, and the Dollar is falling.

This is a

monumentally important trend. De-Dollarization is actually beginning to happen. But central banks aren't

switching to the Chinese

Renminbi or the Euro, they're reverting to classic hard currency: gold. It's re-goldification on a

massive scale.

The era of fiat dominance may well be in its twilight years. And good riddance. Being home

to the world's reserve

currency has hollowed out the US manufacturing base and caused spending to spiral out of

control.

All of this

helps confirm my view that we are still very early on precious metals. Fed printing operations are just

now about to start back up. QE

will eventually reignite, and the scale will likely dwarf previous episodes within a few years.

Depending on who wins the White House,

a stimulus program may be in the works as well.

Gold and silver are absolutely

crucial aspects of a modern

portfolio, and are still wildly under-owned by investors. In the next 5 years, we will likely see a

number of sovereign debt crises,

and/or sustained inflation above 10% in a number of countries. The piles of government debt have simply

grown out of

control.

Lower interest rates will help cut the debt servicing costs (interest

expenses). But there's a good

chance it will also reaccelerate inflation. No matter which path we choose, the piper will be paid for

past excesses.

Eventually, we will experience a true precious metal mania. I suspect it will begin when

gold hits $3000 and silver

breaks out above $49.45, its 1980 all-time high. Everyone will be buzzing about gold and silver. Your

neighbors, friends, and

colleagues. And it will be glorious.

Fortunately, we're not there yet and still

have time to prepare. We may

even get a pullback after gold's impressive run from $2000 in Feb 2024. But then again, we may

not...

Email

us

Email

us